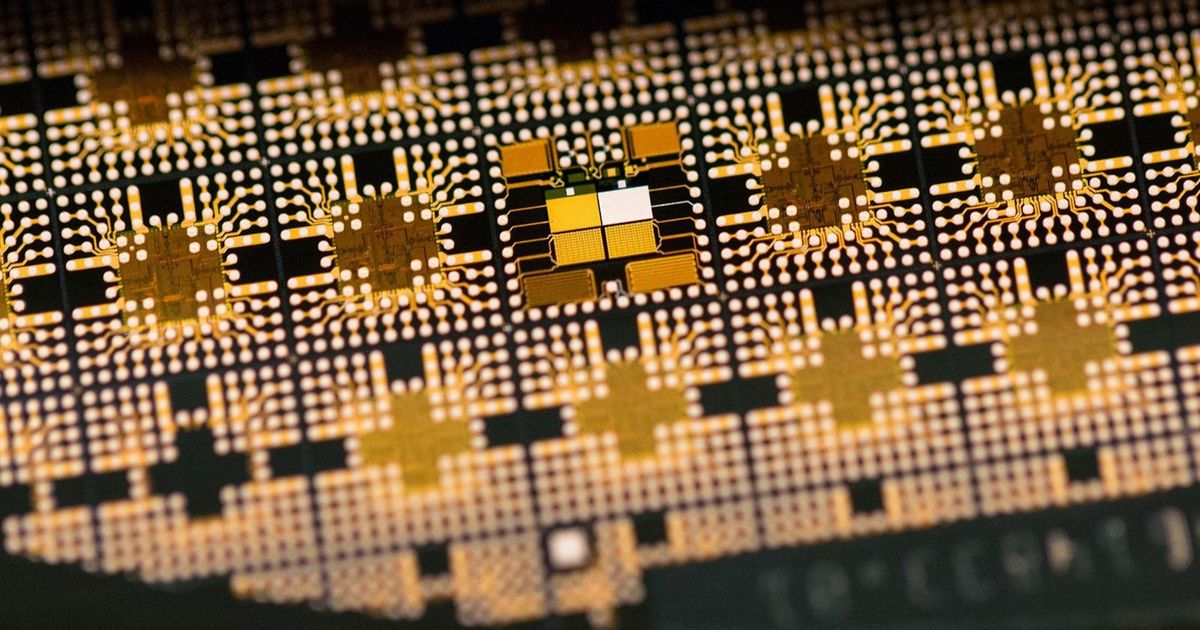

Asian stocks have risen along with futures for US equity indicators, as investors ignore the threat of President Donald Trump to impose 100% customs on chips to the United States. The shares of technology companies jumped. The MSCI index rose 0.9%, while the S&P 500 and Nasdacs index in Asian trade increased by 0.3%. Trump said he would impose these fees on the import of semiconductors, but that he would give exemptions to companies that reproduced it to the United States. The shares of “Invidia” in additional trades increased after the market closed, while the shares of “Samsung Electronics” in Seoul rose 2.6%, and the shares of the Taiwan “TSM” business rose by about 5%. The oil has increased slightly after a five -day decline, as investors have ignored US efforts to punish Russian oil buyers such as India. Treasury effects for ten years also rose one basis point to 4.24%, while the dollar index did not see a significant change. The exemptions relax the markets, and although the news is related to the fees that are concerned, the investors have found some reassurance in advertising that, according to analysts, confirmed the admission of exemptions to companies. The increasing; “To a certain extent, this scenario is a source of relief. Yes, the 100% fees are not liked, but if companies find time to reproduce, the actual tax is only in the high cost of manufacturing in the United States,” said Moraghan Stanley analysts, including Joseph Moore. “We will receive a customs fee of about 100% on chips and semi -conductors,” Trump said in the United States late Wednesday. He added: “But if you are produced in the United States, there will be no fees.” His comments come while Apple CEO Tim Cook unveiled an investment plan worth $ 100 billion in the United States, along with Trump in the Oval Office. To date, Trump has exempt electronic devices, including smartphones, computers and screens, from the ‘mutual’ fees of each country, which will rise on many trading partners on Thursday morning. He pointed out that these products will subsequently be subject to separate procedures associated with imports that include chips. Taiwan said TSMC was excluded from American drawings. South Korea also announced that the chips produced by “Samsung Electronics” and “Sk Hynix” will not be subject to 100%fees. You may also be interested in: mutual and at -festival. What is the difference between them and what is its importance? ‘Trump’s move’ is unlikely to disrupt the most important supply chains. “He explained that the policy has not yet come into effect, and that no executive order or official legal mechanism has so far been published. Possible peace negotiations with Russia and Ukraine, but San Francisco Marie Dali said policymakers are likely to have to adjust the interest rate in the coming months, to prevent a adjustment of the residue market over the past few months. Minneapolis Neil Kacquari said that the economic slowdown can make the reduction of interest in the short term. Capital without announcing any success in reducing customs duties that Trump imposed on her country.

Asian stocks are rising amid the negligence of Trump’s threats of chips