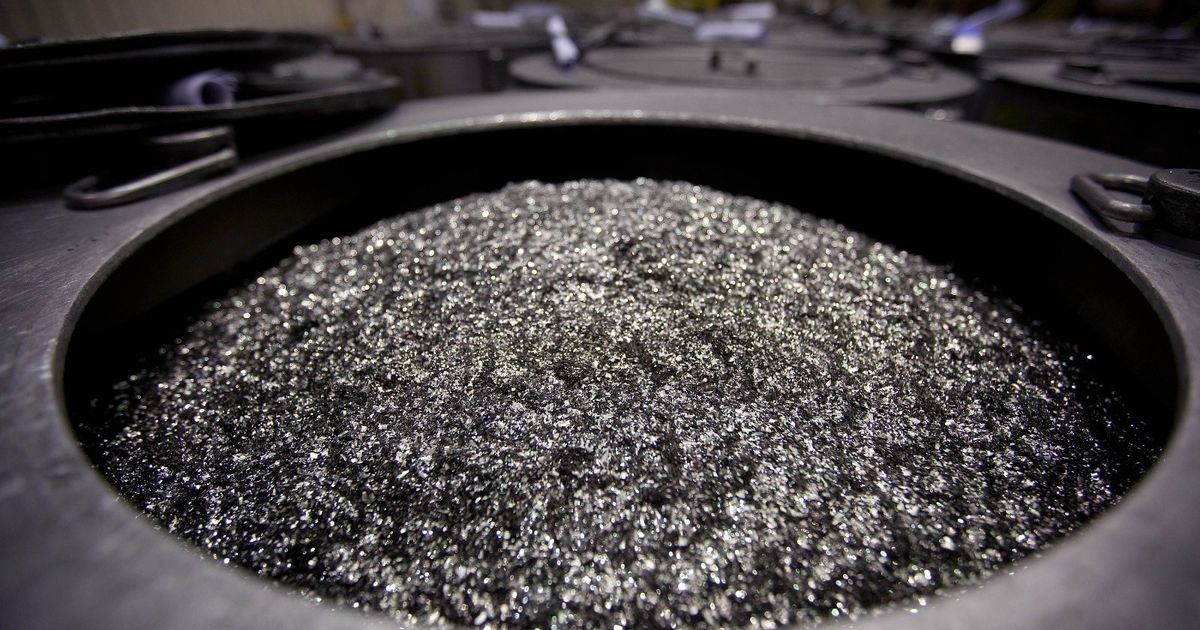

China’s export of rare elements Magnets jumped to the European Union in August, highlighting the dependence on the conglomerate of Chinese supplies compared to the United States, and its disclosure against the tension between Washington and Beijing. The shipping to the European Union increased by 21% compared to July to reach 2582 tonnes, according to Chinese customs data released on Saturday, to increase the quantities since the beginning of the year to more than three times its counterpart to the United States. On the other hand, exports to the United States dropped monthly by 5% to score 590 tonnes. Barely magnets, needed for electric cars, wind turbines and military equipment, became the most important weapon of Beijing in the confrontation with Washington earlier this year. Although the phone call between President Donald Trump and Chinese leader Xi Jinping on Friday indicated the ongoing decline in tension, the fear still exists over China’s control over about 90% of global magnet production. Also read: China’s exports of rare mineral magnets to America are declining in the European Union to adopt the excessive acceptance of the European Union to make its industries especially vulnerable. Despite the recent recovery, the previous supply crisis still affects the block. The European Chamber of Commerce in China said on Thursday that the union companies entered into seven production stops in August, and that 46 additional stops are expected from this month. China’s dominance urged Europe to accelerate its plans to ensure alternatives. The ‘critical raw materials’ of the union came into effect last year, including proposals to regain more rare elements of used electronic devices. The European electric car sector also seeks to obtain supplies from other places such as Estonia. In the United States, Mpap Materials Corp, the only product of rare elements there, plans to start the commercial production of magnets later this year. Chinese customs data only provide partial evidence of the continuous effects of export restrictions, as it only applies to magnets containing rare heavy elements. Data is not set out by type, and it also contains products that do not contain these heavy elements.

China’s export of magnets to the European Union jumps amid an offer crisis