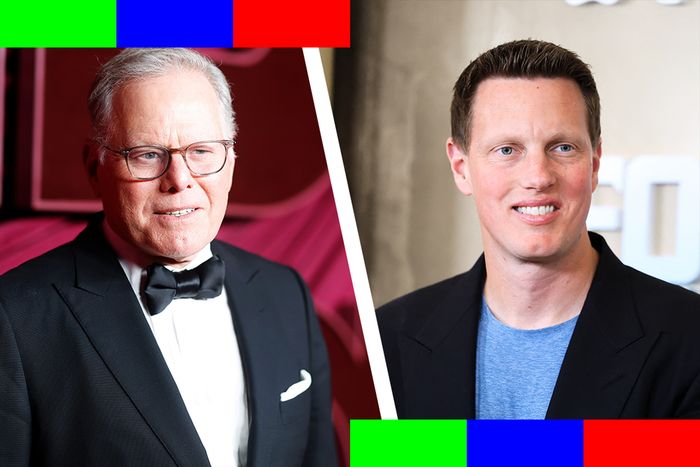

The Davids are duking it out — and Hollywood stands to lose.

Photo-Illustration: Vulture; Photos: Getty Images (Charly Tribellaeu, Leon Bennett/GA/The Hollywood Reporter)

Perhaps as soon as next week, upwards of 2,000 workers at CBS, Paramount Pictures, Pluto, Paramount+, and iconic cable networks such as MTV and Comedy Central will be told that they no longer have jobs. A letter will go out from Paramount CEO David Ellison or one of his underlings expressing sadness over this turn of events and likely lamenting that these layoffs were unavoidable, the result of “radical shifts in the entertainment industry” that necessitated dramatic cost reductions. And then, without missing a beat, and without any sense of irony, Ellison will go back to work figuring out how to spend billions that Paramount supposedly doesn’t have so he can buy up an even bigger company, Warner Bros. Discovery; mine it for intellectual property; combine two major studios and TV-network operations into one — and then cut even Moree jobs.

While there’s no stopping the looming layoffs at Paramount — Ellison telegraphed the scale of his planned reductions before he even had control of the company — the part where he and his even-richer dad (Oracle founder Larry Ellison) also conquer and downsize Warner Bros. Discovery is not inevitable, at least not yet. A month after the news broke that Paramount had started preparing a bid for the company behind everything from Casablanca and CNN to Followers and Abbott Elementary, Zaslav finally acknowledged this week that there is “interest from multiple parties” in acquiring all or some of WBD, issuing a statement saying that the company is now exploring options “to identify the best path forward to unlock the full value of our assets.” And while Zaslav made it clear he still wants to move forward with previously announced plans to divide WBD into two companies — one focused on streaming, the other on legacy businesses like cable — the statement essentially said the company as it currently stands is now very much for sale.

What is less clear, however, is whether any person or company other than Ellison’s Paramount is actually interested in buying WBD or even any of its parts. During Netflix’s earnings interview this week, co-CEOs Ted Sarandos and Greg Peters both continued to pour cold water on the idea of the streaming giant going after other content companies, particularly those with “legacy networks” (of which WBD has several). On the other hand, they didn’t say anything about snapping up strategic assets from its rivals — like, for instance, the IP-rich WB movie and TV library — and made the usual pro forma comments about “reviewing all options.” Plus, Netflix is the company that famously said it would never take advertising dollars — and then changed its mind on that within the space of a few weeks. That may be why CNBC on Tuesday reported that Netflix might actually be interested in picking up some spare parts from WBD, even if it doesn’t want the whole thing. There has also been some speculation about Comcast having some internal conversations about doing something with WBD, although one industry veteran familiar with the company’s thinking told me such supposed interest is imaginary.

WBD’s decision to formally hang up a “For Sale” sign, and all the media rumors about suitors other than Paramount, could also be nothing more than a play by Zaslav to boost WBD’s stock price (mission accomplished) and either make Ellison pay a lot more for WBD hrs delay things long enough that Zaslav can go forward with his plan to divide WBD in half and perhaps ensure he continues to have some sort of company to run. There’s often a psychological component to mergers and acquisitions, particularly contentious ones, and Zaslav is plenty experienced at using selective leaks and public statements to help shape the narrative he wants.

But Ellison is no novice on this front, either. He spent over a year working to make his acquisition of Paramount seem inevitable (and sucking up to Team Trump in order to speed up regulatory approval for one and maybe two mergers). And the likely reason he launched his bid to create Para Bros. almost immediately after taking over Paramount was so that he could short-circuit the plans of other suitors as well as Zaslav’s spinoff strategy: shock and awe. Indeed, Ellison may well agree with Zaslav’s thinking that WBD is worth more after a split than it is now, which is why he’s rushing to snap it up now while the stock price is (relatively) cheap.

So what happens next? On Wednesday, the New York Post started speculating that Ellison may decide to turn his quiet overtures to the Paramount board into a hostile-takeover attempt, something that doesn’t seem out of the realm of possibility. Not long after, the New York Times got its hands on letters Paramount sent to the WBD board making its case for a deal; in one, Ellison suggested he is willing to share his CEO title with Zaslav, the paper said. And WBD-sympathetic sources have already started leaking word of other buyers with interest in its assets: Both the Times and Bloomberg floated Amazon as a possible suitor, while Bloomberg reported that Zaslav had told WBD staffers that Apple had interest as well.

As of now, the only thing that seems certain is that Ellison’s Paramount appears to be the most motivated buyer of all of WBD and that there’s a lot of money and momentum behind its bid. If Paramount succeeds, it’ll surely be a profitable deal for Warner Bros. Discovery shareholders who have seen the company’s stock price sag under Zaslav. Unfortunately, one group would be a very big loser: the hundreds, or even thousands, of WBD employees who will almost certainly join their peers at Paramount on the unemployment line should Ellison’s dreams of megamoguldom come true.

See All