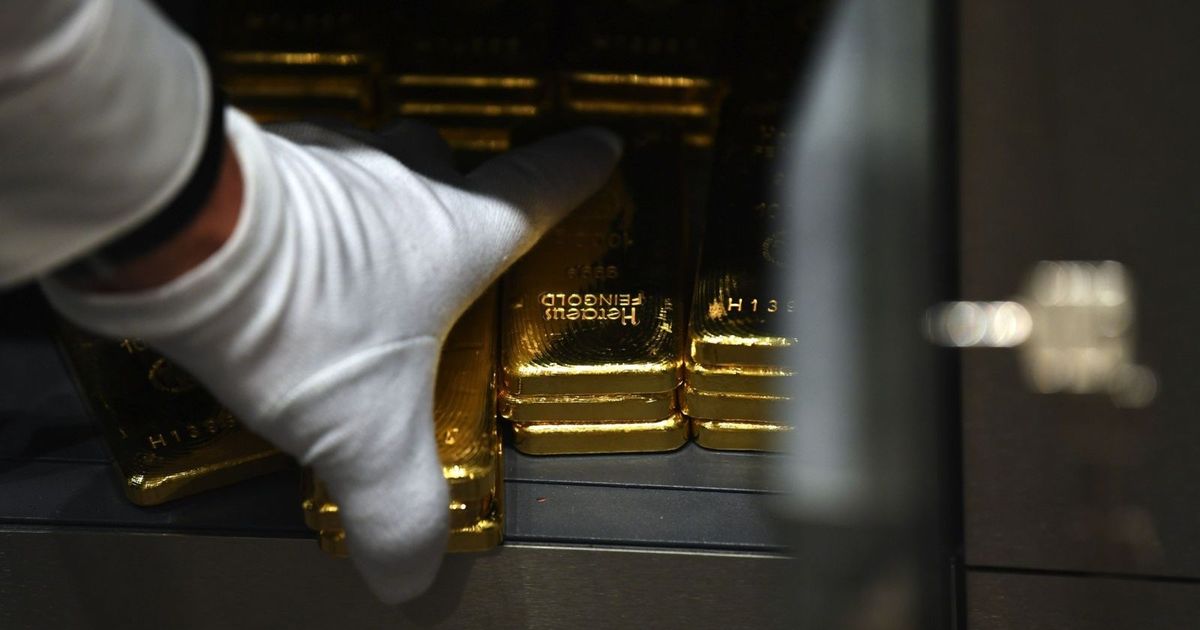

Gold prices rose slightly, paring some of the significant losses recorded this week in a market that has shifted from widespread optimism to fears that the long-running rally has become overdone. Spot gold rose 0.4% on Thursday, after falling about 6% over the past two sessions, as investors continued to assess the prospects for reaching a trade deal between the United States and China that could ease some of the geopolitical tensions that have boosted demand for safe-haven assets like gold in recent weeks. Correction in gold prices Technical indicators have shown that the rising wave was probably excessive, and that the decline this week has helped to calm the market’s intensity. The so-called “depreciation trade”, in which investors avoid sovereign debt and currencies to hedge against growing budget deficits, has been a major factor behind gold’s growth since mid-August. Also read: An unprecedented rush to a Japanese gold-backed fund worries the markets. Gold has continued to rise by around 55% since the start of the year, and prices have also been supported in recent weeks by bets that the US Federal Reserve will make at least one cut in interest rates by a quarter of a percentage point before the end of the year. “After an excessive rally, gold prices are behaving like a rubber band that has been stretched too much, and are now bouncing back strongly,” said Hebe Chen, an analyst at brokerage Vantage Global Prime Pty Ltd. She added, “Prices holding levels above $4,000 indicate a technical correction rather than a fundamental shift in the trade and strong devaluation.” All eyes are on trade talks. Traders are also monitoring the possibility of progress in the talks between the United States and China after the return of tensions between the world’s two largest economies. US President Donald Trump on Tuesday expected his upcoming meeting with Chinese President Xi Jinping to result in a “good deal” on trade, but he also acknowledged the possibility that the meeting would not take place. Also read: America is considering imposing broad restrictions on software exports to China. Chen said: “Markets are taking a balanced position against commercial and geopolitical noise, which is a cautious position but based on a realistic degree of optimism.” Spot gold rose slightly to $4,119.74 an ounce at 10:24 am. Seen London time. The Bloomberg Dollar Spot Index also rose. Silver rose 1.8% after falling 7.6% in the previous two sessions, while palladium and platinum rose. (Prices are adjusted to reflect market movements)

Gold prices witnessed a slight rise after two days of heavy losses