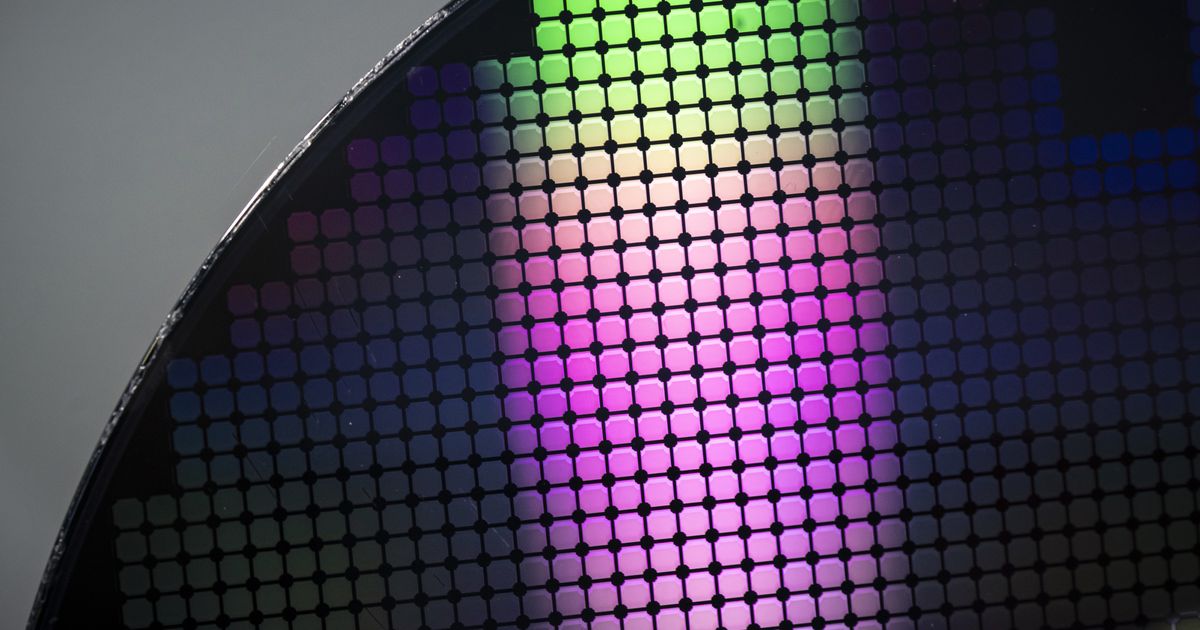

The inventory index of the international manufacturers and the leading company, “Nvidia”, has decreased in the field of artificial intelligence, indicating the slowdown of the most obvious engine for the global stock market over the past year and a half. The Philadelphia Stock Exchange Index for the shares of semiconductors, as well as the shares of “Inviteia”, fell by more than 3% yesterday before reducing the losses at the end of the trade. In addition to the fear that the heights may become excessive, the sector has been influenced by the fear of postponing the Federal Reserve for interest rates and the weakness of the economy of China. Intel challenges “Invidia” with a new segment of artificial intelligence. The Dutch Chip Equipment Company “Asml Holding NV” on Wednesday led the decline in the SO -Name “Philadelphia for Transportation”, known as “Sox” after it recorded disappointing requests for the last quarter of the year. The purchase, despite the steadfastness of China’s backends of the least developed machines in US restrictions. A 9% increase in net revenue to reach $ 225.5 billion Taiwanese ($ 7 billion) for the first three months of the year, with the agreed estimates. Artificial intelligence pays “TSMC” to record the first growth in profits in a year. Advisors), the results of “Taiwan Simonukone Manovakchurring” were not very bad. However, he explained that the company’s business in China “is likely to drop to zero, given the wonderful local ability the Chinese build.” He added that the mascak that does not work in producing the latest chips can be influenced by the high energy costs. US deposit certificates from Taiwan Simonokind Manovakchoring fell 6.8% in March. The execution of “Advanced Micro Devices Inc”. Intel is one of the biggest factors affecting the SOX index in the decline of the correction, as the shares of the two companies have fallen by more than 20% since the highlight of the index on March 7.

Invidia shares and Chips businesses are on their way to correction with changing interest expectations