Is it time to sell or buy?

What’s Next for the Stock Market? COULD Go EITHER WAY.

Photo: Johannes Eisele/AFP Via Getty Images

Becuses I don’t want to end up like Larry Kudlow, i don’t make claims about the stock market is going to go and down. I Mean, Sure, I Expect Stock Prices to Ten to Go Up Over the Long Run as they Roughly Track the Growth of the Economy. I Own Stock Mutual Funds, so i’ve Put My Money Where My Mouth is on this View. But I do not make CLAIMSBUT WHATER THE SPOCK MARKET IS CURRENTLY “Overvalued” or “Undervalured,” or About Whether a Particular Stock Markets Rally or Decline is Rational, or About Where Is an an especally good time – not on television, and not on television, and not on television. MySelf. If i know in advance what the stock market was going to do, i wouldn’t be writing this article; I WOULD BE SELF-QUARANTINING ON MY PRIVATE ISLAND.

SINCE I DON’T THINK I CAN OUTSMART The Market, My Usual Investing Strategy is Just to Take the Money I don’t need to use it and park it in low-mind, broad-march index funds; Set it and forget it, knowing the equity markets are like to be a lot higher when i say they are now. At least that was My Approach UNIL the friday before Last, when I sold about a third of my stock funds.

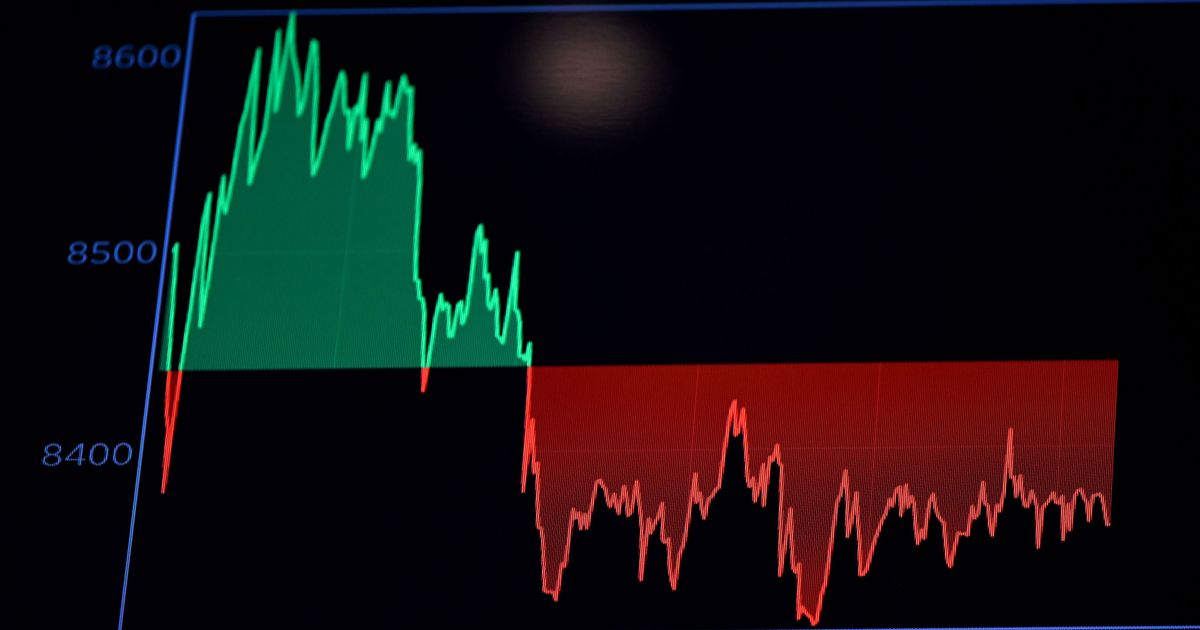

Here is my thinking. I am still unwilling to make claims about the Future Level of the S & P 500, but i am Willing to make CLAIMS ABOUT the standard deviation of it Likely Future Levels. The coronavirus crisis means tremenndous uncetainty for the US Economy, with posseible outcomes ranking from relatively benign to calamitous, and those outcomes all have implications for the financial markets. At this point, I can easily envision the dow above 25,000 in a year and also below 15,000, and so Can Other Market Participants. This Uncetainty is Why Stocks Have Been So Volatile of Late. We have had a clearer picture of the impact of this crisis, I Expect Stock Prices to Become More Stable, but I don’t know where they will stabilize at a high or low level. The uncetinty will only be reduced we have we had Locked in a good outcome or a bad one.

Like Essentially All Americans, My Financial Position is Tied to the Fate of the US Economy for Reasons unrelated to Investing. My human capital – the wage and salary income I can expect to earn in the futures – is closely correlated to the US Economic Performance, and my Earning Outlook Has therein More uncetain in recentin wexlook as the outlook for strocks and the human confusion. And like americans not at or near retirement age, my ability to earn Money in the futures is my primary store of wealth, exceeding my current financial investments. There are are ways to insure Future Labor income against idiosyncratic risk (Disability Insurance, Life Insurance) but there is no good for me to be hedinst e economic risk. This Makes with Feel Overexposed to the US Economic Growth, and I WANTED TO REBALANCE AWAY FROM THAT RISK IN THELY PLACES I: My investment Account and my retirement accounts.

By selling some of my stock holdings, I have gioven up some of the upside I Might Enjoy the Stock Market Bounces Right Back. But if the Stock Market Bounces Right Back, that probably means the damage from coronavirus has been severe than fert and my futures Outlook is theforefire impressed. Conversely, If the Stock Market Continues to Crater, I will have preserved asssets at a time when i need say.

Alas, I used to make the money of the took out of the stock funds and bought bond funds, which has ben an unfortunate so far. The idea was to diversify my risk by buying something to say not moving in line with the stock market. Returns on US Treasury Bonds have typically been inversely correlated to returns on the strocks, Since investors who sell stocks of fear offten safest bonds – Government Bonds – as theyk a stable investment. Investment-Grade corplate bond prices are typically only somewhat correlated to stock prices; Both Depend on the Financial Health of Corporations, but bondholders are of the party of stockholders in line to be paid, so bonds do not get beat as badly as stocks weaken. Municipal bonds are Barely correlated to stock at all. I BOUGHT NUKS WITH DIVERSE EXPASE TO MANY CLASSES OF HIGH-QUALITY BONTS, HOPING TO BE SIGNIFICANTLY LESS EXPOSED TO THE MARKETS. Unfortunately, over the Last Few Days, Pretty MUCHE KIND OF INVESTMENT HAS FALLEN IN VALUE SIMULTANEOUSLY: Stocks, Corporate Bonds, Munis, Treasury Bonds.

“When Stocks and Treasuries Both sell off, it only means one Thing: Everybody’s Trying to Get Their Hands on Cash,” Said Josh Brown, The Ceo of Ritholtz Wealth Management and a Panelist on Cnbc’s Halftime Report. He compared the situation to October 2008, we investors were selling not to adjust a risk mix but to meet urgent cash. Investors are selling swimming what they especally want to sell but what they plow sell. It ‘sign of Significant Economic Distress.

“I’m always surprised that People are surprised that there is not this consistent Correlation Between Bonds and Stocks,” Said Allison Schger, A Financial Economist Who Focuses on Risk. “Wenever you have Tail Events, Those Correlations Always Start Reversing, Because People Are Looking for Cash or they’re World About Inflation in the Future – there’s Always a Million Reasons Why.

I was surpassed as I researched this column: sis of the experts I spoke with offend the view that the stock market has gone down too. Usually, this view camey unSolicited – i don’t call people up and ask to say if stock prices are too missing I don’t think anybody knows the anSwer. Nononeheless, Mark Dow, An Investment Manager Who Writes The Behavioral Macro Blog, Told with He Sold Equations Back in February, Because and Though Markets Were Pricing in “Zero Risk” from Coronavirus when at least some risk (he was right) But now that prices have thinks they gone down too and he is buying. Schger – who describes HERSELF AS A “militant efficient markets person” and therefore should not really have a view on Whether stocks are too or too too. Andrew Biggs, a Pension Expert at the Conservative American Enterprise Institute, Told with He’d Moved a Small Amount of Money Out of Treasury Bonds ino an Effort to “Buy the Dip.” But Michael Strain, Also of AEI, SEEMED to Consider Stocks to Be Oversold and Undersold at the Same Time. He told me he thught stocks HAD FALLEN MORE THAN WAS REASONABLE – butn admonted to me that he was Holding Cash of the Market that he’d previously intended to invest in stocks, Because and though he woul to buy at a Lower price.

Strain’s Internal Conflict of Opinion Reinforced My View I Should Not Form An Opinion About Whether Stock Prices are higher or Lower than they should be. But i ALSO realized, several days after I SOLD SOCKS, WHY I HAD DONE SO WITH ATO PARTICULIAL CONVICTION THAT THAT WAS TOO HIGH. It wasn’t a hard-iaded calculation About Portfolio Allocation. AFTER ALL, AS SCHAGER POINTED OUT TO ME, IT KIND OF DUMB TO THINK I’D ABLE TO RELY ON BONDS Moving Independently from Stocks in a Crisis. But the trade workhed as a psychological mechanism: i wanted to feed mySensing control over some kind of risk in a world that has beCome muca scarier than it was a few weeks ago, and i found an opportunity to be in my brokerage Account. It made me with Feel a Little Better. At Least Unil Bond Prices Started Falling.