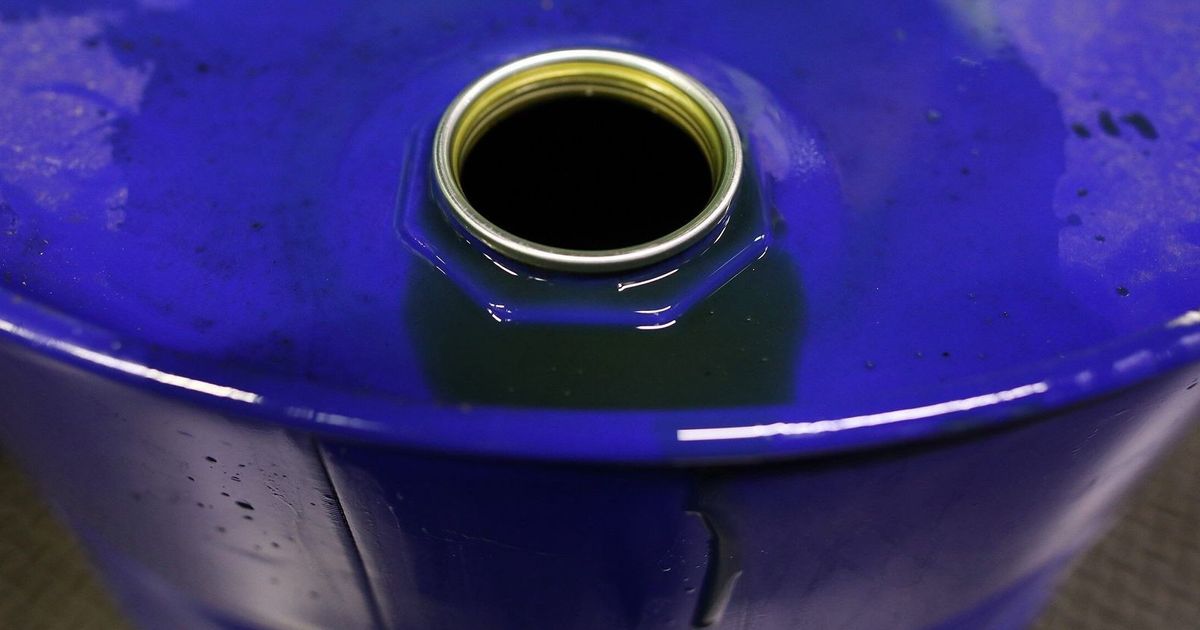

Oil prices are expected to decline to a range between $ 51 of $ 59 a barrel in the upcoming classes due to the expectation that a ‘hard glut in the offer’ with increased production, according to ‘Macquarie Group’, which has reduced their expectations. The analysts of the company, including Marcus Garvi, said in a report about the quarterly expectations of a large group of raw materials: ‘We are still mainly pessimistic about the energy sector’, and in light of the increase in the supply of rough by the “OPEC+” coalition, as well as non -member states, ” During the period of the year and in the year and in the year and the following year in the period of the year. year. The outputs of the “OPEC+” meeting, the price of Brent, waited by about 11% this year, with a consecutive monthly decline in September, with the “OPEC+” production restrictions fast, in an effort to restore the market share. Also read: The Head of “Kuwaiti Petroleum”: The strong demand for oil in the production of OPEC+is increasing. The coalition is scheduled to meet at the end of this week to determine production levels in November, and the member states will accelerate with about 500 thousand barrels per day according to one of the delegates. At the same time, OPEC denied such a plan. Oil prices are falling next year and the “Macquarie” analysts indicated that “with Saudi Arabia does not express an indication of the withdrawal of its re -statements, we expect in the absence of this decline that the market will face an environment in which prices will continue for a longer period. -States in OPC states will combine, which will change low prices, which will change in the production of Non -non -Member states) (OPEC) policy, and will require the returns of the market for the balance period (which enables growth in growth to accommodate the exhibited gambling).

Makawari: The price of oil can be traded in the early 2026 of $ 50 per barrel