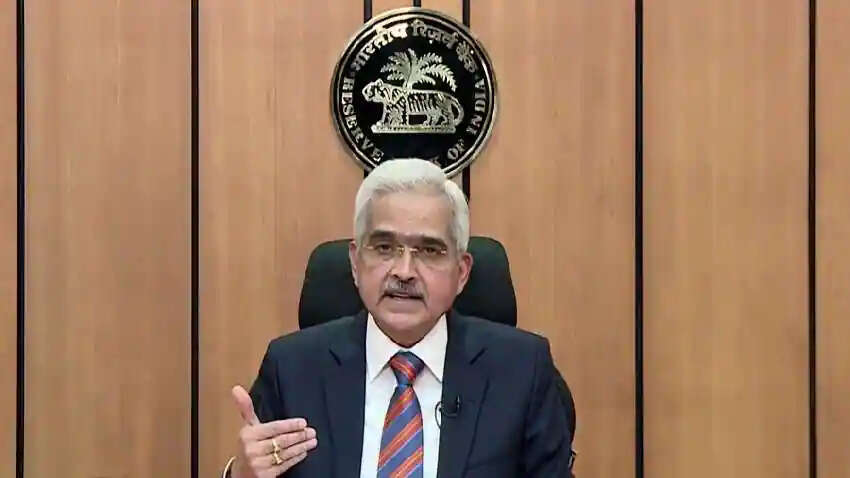

Business News Desk, the Reserve Bank of India (RBI) said that the NPAs (NPAs) of banks came to a low to 5 percent of seven years. The central bank said the banking system remains strong and has enough capital. In the 26th edition of the Financial Stability Report (FSR), the RBI said that the global economy is facing unfavorable conditions with a risk of large -scale recession. According to the report, financial conditions have been tightened due to various tremors and financial markets instability has increased. The financial system said in a good situation, the report states: ‘The Indian economy has faced the global conditions. Nevertheless, the financial system is in a better position due to strong macroeconomic fundamentals and a strong balance sheet of sound financial and non-financial sector. The FSR says that NPAs may fall at 4.9 percent in the coming days. The capital situation of scheduled commercial banks (SCB) was strong in September 2022. Risk -weighted property ratio (CRAR) of capital and general share capital (CET1) ratio was 16 percent and 13 percent respectively. In the introduction to the pressure relief report of the intervention, RBI Governor Shaktikanta Das said that the central bank recognized the possibility of instability as a result of global risks. “The Reserve Bank and other financial regulators are attentive to ensuring stability and strengthening the financial system through proper intervention, where necessary, where necessary, in the best interests of the Indian economy,” he said. On inflation, the report states that although prices remain high, the financial operation and the intervention of the supply side reduce pressure. Share this story

Prosperous New Year 2023 RBI’s Relief News for Banks, NPA becomes the lowest in seven years