Reserve Bank of India (RBI) Governor Sanjay Malhotra announced a 50 -basis points or 0.50 percent in the repo rate on Friday at the Monetary Policy Committee (MPC) meeting. This is the third consecutive time RBI has reduced the repo rate to promote economic growth. Now the repo rate has dropped at 5.50%. It can also affect your home/car loan EMI. The banks involved may decide to reduce it. The deadline for changes in the Repo rate of India since 2020 is as follows: -Drate (%) Effective date 5.50 06-06-2025 6.00 09-04-2025 6.25 6.25 07-02-2025 6.50 06-12-2024 6.5024 6.50-2010-2024 6.5024 6.5024 6.50 08-02-2024 08-12-2024 6.50 08-02-2024 6.50 08-12-2024 6.50 06-10-2023 6.50 06-04-2023 6.50 08-02-2023 6.25 07-12-20225 07-12-2022 5.90 30-09-202222222222222222222222222222222222222222222222222222222222222222222 2.2022.406-20-20-202405-20-202405-20-20-20-20-202405-20-2020202020 22-20-20-20-20240 27-20-20-20202020202020 220-20-202020202020202020. 27-203 06-02-2020 Share this story Tags

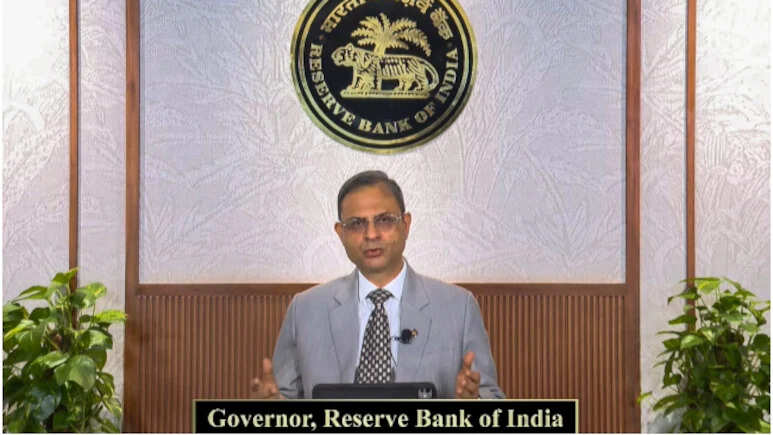

RBI has lowered the repo rate for the third consecutive time, now the decision to cut 50 basis points can be reduced EMI