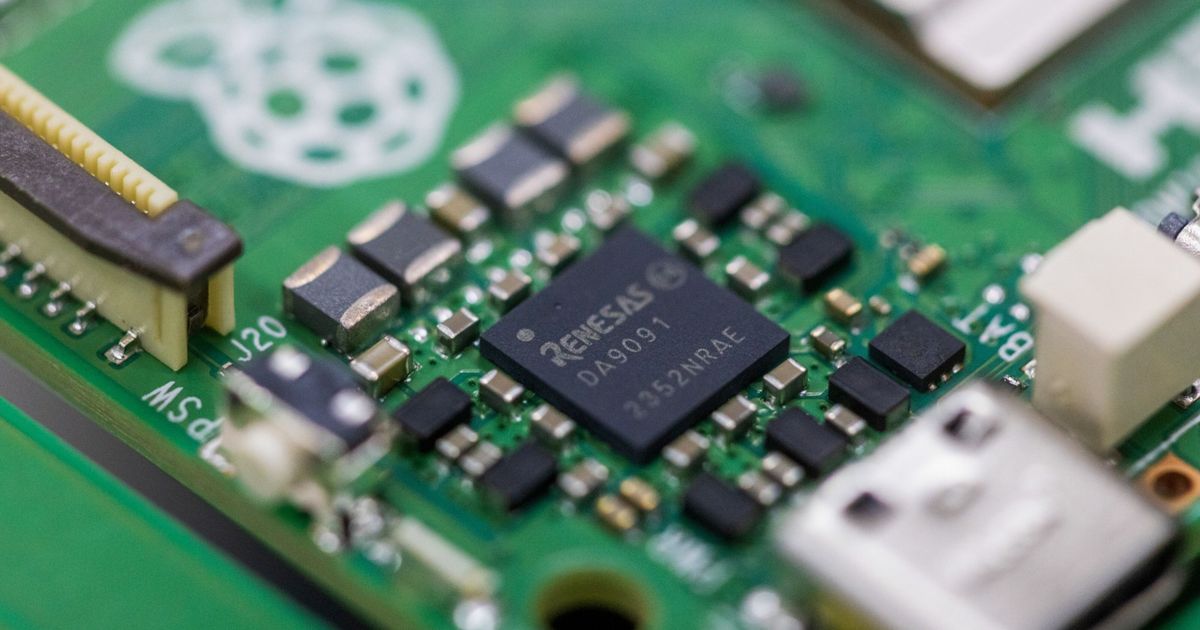

Renesas Electronics Corp has agreed to the semiconductor industry to buy the Altium Ltd software, for $ 9.1 billion ($ 5.9 billion), which is the largest acquisition of a company listed by a Japanese buyer in Australia. The company, which is based in Tokyo, said in a statement today that “Renishsas” will acquire the shares of “Altium”, listed in Sydney, but the headquarters is San Diego, for a cash in exchange for the Australian $ 68.50 per share. The agreement, funded by bank loans and cash, represents a 33.6% bonus on the “Altium” price on Wednesday. Altium shares rose 31% in Sydney this morning. Renish’s shares fell 4.9% in Tokyo. RenishSas is an important source for car and energy connections and has close ties with Toyota, Nissan and Honda, but it is on their way to the most profitable compact processors. The company, which has acquired the UK, is based on the UK, for $ 6 billion in 2021, is to expand software services with the high demand for support in the combination of semiconductors in increasingly complicated products. “With the progress of technology, the design and integration of electronic systems has become increasingly complicated,” according to the company’s statement. She added, “In light of a joint vision, the two companies (Renas and Elum) aim to build an integrated and open platform for the design of electronic systems and managing the life cycle.” The shares of “Altium”, whose software is used by companies such as “Bang & Olufsen” and “Leica Geosystems AG” to design the printed circuit boards for the devices, after refusing to offer a “otodiseec” acquisition of about $ 4 billion. Canadian Autodesk in July 2021 said Altium that the offer was very low due to the company’s growth prospects, especially as it went to the cloud software. “The electronics are affordable for everyone, which is strongly echoed with altium.” Alatium consultations are offered by ‘GB Morgan’, ‘King & Wood Malicons’ and ‘Reid Smith’ as legal advisors.

The Japanese “Renishas” grab “Altium” for software for $ 6 billion