When DCM wrote the first institutional take a look at into the pick technologies, the meslo park-baed venture firm turned into Making a likelihood bet on bots of blockchain technology and a founder with a checkered previous. Nearly about Eight Years late, that resolution is location to ship one of dcm’s supreme wins: a stake on the realm of 60x its well-liked fee, in conserving with the opening discover’s nasdaq debut.

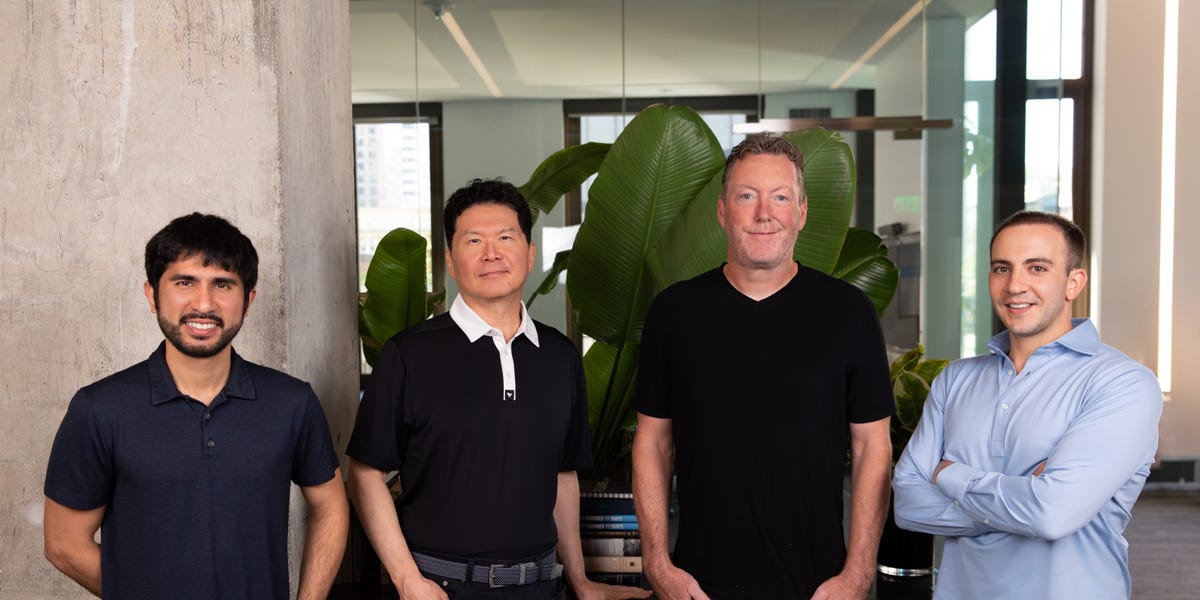

DCM LED Figure’s 2017 Seed Round With A $ 10 Million Review, In the raze Turning into The Company’s Increased Venture Backer with 11.3% Possession, Acciting to Regulatory Filings.

The Company’s Shares opened at $ 36 a Share on Throlsday, Nearly about 30% Above the IPO Brand, Persevering with A Dash of SuccessFul Public Lisings. In step with Thursday’s Share Brand, DCM’s Stake is Valued at $ 600 million.

AFTER YEARS OF LITTLE TO NO IPO ACTIVITY, The Market In the raze Roared Aid to Lifestyles This Summer, Capped by a SuccessFul Debut for Figma. This Week, Klarna, Which Had Been Private For 20 Years, Went Public at A $ 15.1 Billion Valusion. Meanwhile, Stubhub Launched its IPO Roadshow Monday.

David Chao, DCM’s Cofounder and Traditional Accomplice, First Heard the Pitch in 2017 for Figure From Its Founder, Michael Cagney, Over His Accepted at Balboa Cafe, No doubt one of San Francisco’s Oldest Restaurants.

“He cherish eating hamburgers,” recalled chao. “He’s Continually Ordering Burgers.”

Cagney Fleet Laid Out the inefficiencies he had Battled while Building Sofi, the Private Finance Company he left that identical year.

“He turned into hungry, he wanted to notify Himself, and he wanted to interchange the artificial again,” Chao Acknowledged.

Cagney explained that at any time when sofi originated a pool of loans, Merchant banks needed to take a look at and kit impart before they’ve been sold to establishments love fidelity-a Unhurried, Paper-heavy process where Middlemen Skimmed Prices Adduing Diminutive Brand. Cagney’s Solution turned into to use blockchain as a ledger that COULD Replace Dear Intermediars.

Chao turned into sold on Cagney’s Vision on the Predicament.

“There are few geniuses in the field in every substitute, and I indulge in he one of impart,” Chao Acknowledged. “His Mind Strikes 10 Cases As Quickly As All of US Blended.”

That’s though chao turned into happy, he unruffled Wished to sway his partners, who viewed one thing connected to blockchain as suspeicious.

“It turned into a Controversial Deal Eve Within DCM,” Acknowledged Chao. “We didn’t indulge in any proof functions. We didn’t know where the banks beuld join the ecosystem since it turned into blocchain.”

Some Also Had Dubts About Cagney Himself, Who Had Departed Sofi Following Studies of Inappriate Relationships With Employees and Considerations About Company Culture.

“I needed to be happy that is a clear particular person,” Chao Acknowledged.

Chao, who has served on Sophie’s Board, Acknowledged he somehow saw Cagney Had Learned from His Mistakes.

“I Spent Six Months With Mike AFTH he Left Sophie,” Chao Acknowledged. “WE TALKED VEY OFTEN ABOUT WENE HE BUILDS The NEXT Company, How and Waled will otherwise issues.”

Chao said the diversities on the pick had been apparent from the starting place, because the cagney constructed a differenture than Sofi, with stricter controls and governance.

“If i didn’t stumble on a Changed particular person, it wouldn’t indulge in took draw,” chao said.

Chao Says Cagney Also Learned How to Be More Capital Atmosphere friendly, Which Allowed Figure to Preserve Lean As Many Various Fintech Firms Raised Too Money and Dangle been Compelled To Elevate Down Rounds.

Chao Also Aspects to the Company’s Balance Sheet, Which Showed A Salvage Profit of $ 29 Million This one year, Reversing a $ 13 million Loss from the length.

“99% of the Fintech Firms that are usually not worthwhile when they lope public,” Chao Acknowledged. “We are the supreme firm that is going to be worthwhile at ipo.”

Chao Credit ranking HIS Longstanding Relationship with Cagney, Which Start up Wen they First Met 2012, we invested in Sofi’s First Vc-Backed Round, with Helping Him Land Seed Investment in 2017.

“If there any Legend right here, that of that vc is Aloof a Relationship Enterprise,” Chao Acknowledged. “Mike Would perchance well Dangle Taken Money From Anybody, but he’s Very Real. He wans to work with Of us’s work with for a extremely long time. Same with us.”

Source hyperlink