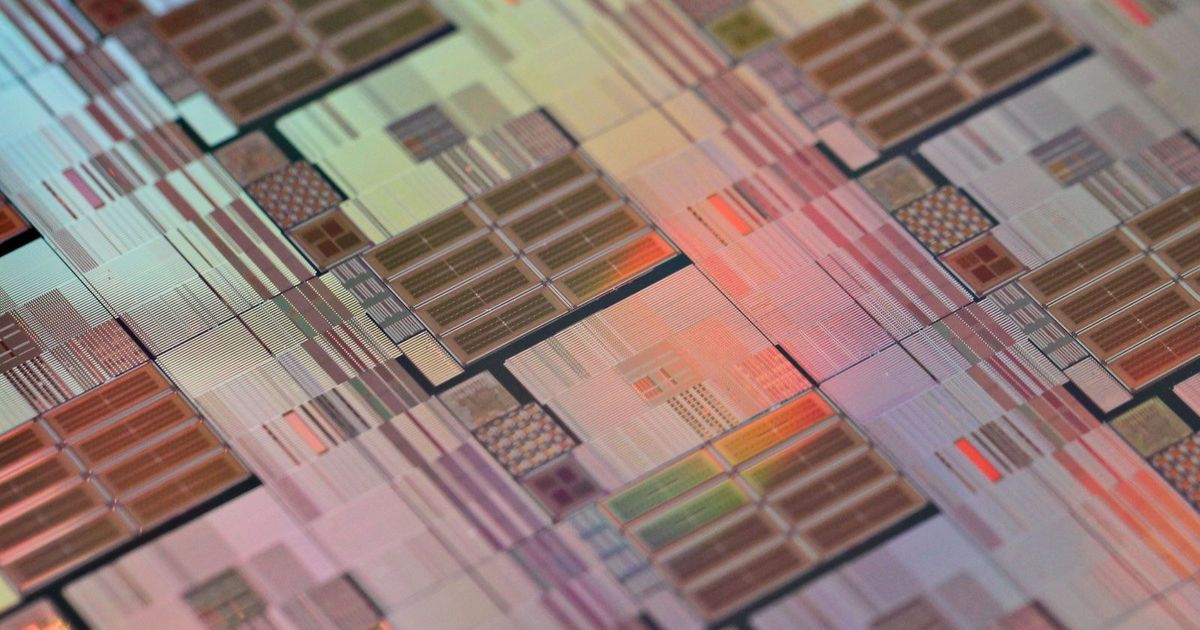

Taiwan Semiconductor Manufacturing Co. ( TSMC ) raised its revenue growth forecast for 2025 to the 35% range, a strong sign of its confidence in demand for components such as Nvidia chips that power artificial intelligence technologies. The company also raised its minimum capital spending target for the current year, after announcing a 39% jump in profit that beat expectations, to 452.3 billion Taiwan dollars (14.8 billion US dollars) in the quarter that ended in September. Taiwan’s largest company is now allocating at least $40 billion to expand and upgrade its capabilities in 2025, up from a previous minimum of $38 billion. The second forecast upgrade since July The results highlight how TSMC, the primary chipmaker for Apple Inc and most of the world’s largest semiconductor design companies, remains one of the biggest beneficiaries of a wave of spending on AI infrastructure, which is expected to exceed $1 trillion over the coming years. From OpenAI to Oracle Corp, tech companies are racing to build data centers that support this technology in the post-ChatGPT era. TSMC’s sales rose 34% in August with strong demand for artificial intelligence.. Details here. This investment rush, coupled with the rapid rise in tech company stock valuations, has led to comparisons to the dot-com bubble, given the continued absence of large-scale artificial intelligence applications and services. TSMC’s new forecast increase is notable, as it last raised its revenue guidance estimates in July. At the time, the company said it expected growth of “about” 30%, while today, Thursday, executives expect growth to reach the 35% range. Artificial intelligence at the heart of upgrading expectations As the world’s most advanced semiconductor manufacturer, TSMC plays a pivotal role in the wave of investments in artificial intelligence, of which Nvidia is at the heart. The company produces powerful accelerators essential in training and managing artificial intelligence services such as ChatGPT and Google’s Gemini. Also read: Artificial intelligence is capable of transforming the economy, even if it is a bubble. TSMC is also the sole maker of processors for the iPhone and many other devices, at a time when demand for electronics remains uncertain, in light of the mutual trade dispute between the United States and China. Potential disruptions after China’s rare-earth curbs Companies across the global semiconductor supply chain are bracing for potential disruptions after China imposed restrictions on exports of rare-earth metals — essential to most tech devices — and the United States responded by imposing additional tariffs and restrictions on software sales to the Asian country. set. Read more: Besant expects sweeping global response to China’s new restrictions on rare earths However, ASML Holding NV, the main supplier of equipment to the Taiwanese chip company, said on Wednesday that demand for its most advanced chip-making machines is booming thanks to the artificial intelligence boom. Bloomberg Intelligence Opinion: TSMC’s preliminary third-quarter sales were NT$990 billion (US$33.05 billion), beating expectations, reflecting strong demand for AI and iPhone chips and indicating a gross margin at the upper end of the expected range of 55.5% to 57.5%. This momentum is expected to continue during the fourth quarter, as strong orders for A19 chips manufactured for Apple and Nvidia’s Blackwell should largely offset the usual seasonal effects and barriers related to customs duties, which are likely to result in a slight decline compared to the third quarter, achieving growth below the expected annual growth rate of 11%. -Charles Shum, analyst. TSMC CEO Si Si Wei has repeatedly emphasized his confidence in the sustainability of demand for artificial intelligence. However, he warned in July about the uncertainty surrounding Trump’s tariffs and geopolitical tensions in general. The company’s expansion into the United States aims in part to mitigate these risks, as it has pledged to invest $165 billion to improve manufacturing in Arizona, as part of a global expansion plan that also includes Europe and Japan.

TSMC is betting on the artificial intelligence boom by raising sales expectations