GST (tax on goods and services), ie tax on goods and services, was implemented in India in 2017. Its purpose was to consolidate different taxes in the country and facilitate the tax system. After implementing GST, its rates were changed from time to time. These changes directly affect the general public, and it also includes the student community. Students, whether from school, college or university, often manage their lives in limited budgets. Therefore, the decline in GST affects their lives on many levels. In this article we will know in detail what and how the GST rate reduction has an impact on the life of a student. 1. Direct effect on educational material is the most important things for students – books, notebooks, stationery and other educational equipment. All of this comes under the purpose of GST. If there is a decrease in GST about this, students get this material at a cheap price. For example, if the GST drops on a textbook from 12% to 5%, the price of each book saves some rupees. Although this amount looks less alone, the total saving of the student is increasing significantly during the semester or year. Stationery such as pen, pencil, ruler, journal and notebook are also everyday requirements. Due to the decline in GST, expenses are reduced. It offers direct advantage to the students because they get the goods needed for their studies at a lower price. 2.. Impact on electronic equipment and digital education has nowadays increased the importance of technology in education. Students use things like laptops, tablets, printers, keyboards, headphones and internet for their studies and projects. If the GST on these devices is low, prices will drop. For example, if the GST drops from 18% to 12% on a laptop, the student must pay at a cheaper rate on that laptop. On online education and e-learning platforms, the decline in the rate of GST, digital courses, online tests and educational apps becomes cheap for students. This is especially beneficial for students who live from the home and are more dependent on online studies. 3.. Impact on food and daily requirements Students living in residences or manage their own expenses are important for daily food, snacks, drinks and other use items. The price of these items descends due to decline in GST. For example, students can save some in their daily expenses due to the decline in GST on milk, quark, rusks, juices or snacks. This saving offers direct benefits at a small level, but over time it has a major impact on the monthly budget. Students can use these savings in other requirements, such as books, online courses or additional education materials. 4. Effect on entertainment and cultural activities, students’ lives are not limited to studies only. Entertainment, sports and cultural activities are also important to them. GST also applies to films, concerts, online streaming platforms, video games and sports material. Due to the decline in GST, the cost of these activities is reduced. For example, if the subscription of an online stream platform is at 5% GST instead of 18% GST, students can take it cheaply. The result of this is that students can better manage the budget for their entertainment and cultural development and avoid extra expenses. 5. Improvement in general budget and financial freedom students often remains on a limited budget. They must take care of their fees, educational materials, daily expenses and entertainment. The decrease in GST reduces their monthly and annual expenses. Saving in small expenses gives students financial freedom. For example, students who work part -time or carry their own expenses can use their savings for a long time. Students can use their saved money in textbooks, online courses, sports activities or other development functions. Thus, the decline in GST students enables financially. 6. Spiritual and social impact Financial pressure in student life is a common problem. It is difficult to balance limited resources for fees, books, residence expenses and daily requirements. The impact of GST reduction also gives spiritual relief to students. The student now has less concern that their needs are expensive. Low prices and increased savings give students the freedom to focus more on their studies and personal development. This is also important from social point of view. Students can now use education and entertainment at the same level at the same level. It also helps with their self -esteem and social balance. 7. Consider practical benefits by example that the monthly issues of a student are as follows: Goods/service monthly expenses (rupees) Savings from GST reduction (RS) new price (RS)) Handbook and Stationery 1500 45 1455 Laptop/Electronics 5000 250 4750 Food and daily use 3000 90 2910 entertainment (stimming)

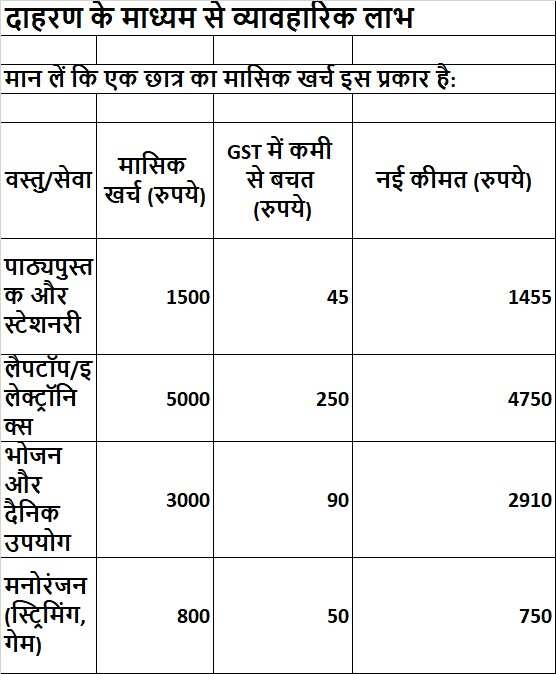

What has changed to a decrease in GST tariffs in the life of a student and how?