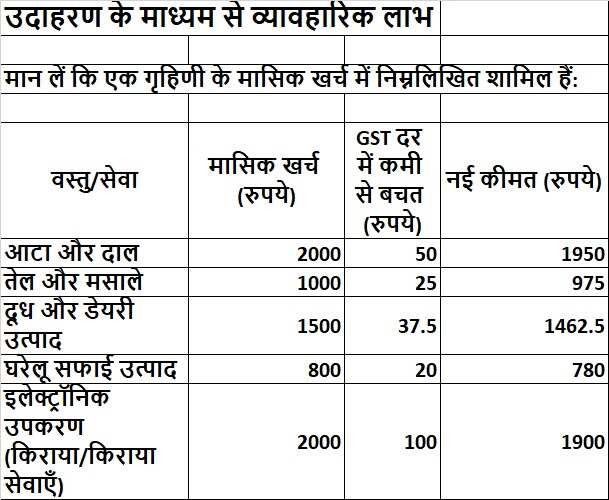

GST (tax on goods and services), ie tax on goods and services, was implemented in India in 2017. Its purpose was to consolidate different taxes in the country and facilitate the tax system. After implementing the GST, its rates were changed several times, and each change directly affects the general public, especially housewives. The housewife, that is, the member of the household that manages the expenses, budget and daily needs of the home, experiences directly changes in GST tariffs. In this article, we will know in detail what the reduction in GST tariffs affects the life of a housewife. 1. Effect on everyday domestic needs, most of a housewife’s life, provided in everyday household needs. This includes flour, pulses, rice, oil, spices, milk, vegetables, fruits, beauty products and other daily use items. If the rate of GST is low on these items, their prices will fall directly. For example, if the GST drops from 5% to 2.5% on a brand flour, the total price of 10 kg of flour saves a few rupees. The effect of this saving is also visible in small editions. The housewife gets many opportunities every month when she can balance her home budget by spending less on daily needs. The decline in GST rates therefore makes the purchase of everyday items cheaper and brings economic relief to the housewife’s life. 2.. Improvement in budget and financial management is the most important task of a housewife to manage the budget of the home. She decides how much will be spent in the month. GST -reduction requires less money for daily expenses, which gives relief in the total budget. For example, if the monthly grocery expenses of a family are Rs 15,000 and save up to 5% due to a decrease in GST, the housewife can save about Rs 750 each month. This saving can be used in small expenses such as children’s education, health, home appliances or other requirements. The decline in GST tariffs therefore not only reduces direct expenses, but also gives the housewife more flexibility in her financial management. 3.. Impact on expensive home appliances and services these days most homes acquire electronics, furniture, cleaning equipment and other home appliances. Services must also be paid for services such as cleanliness, care and recovery of the home. If GST drops on these items and services, their prices become cheaper. For example, if the GST on home appliances such as mixers, washing machines or fridge decreases to 12% to 5%, the housewife gets financial facility to make major purchases. In addition, GST reduction on home -related services can easily benefit from these services, such as household cleaning, installation or home delivery services. So the decline in GST tariffs helps the housewife to make life simple and convenient. 4. Effect on online shopping and digital transactions, these days housewives also use online shopping. Groceries, clothing, home appliances and other items are available on the e-commerce platform. The decrease in GST also lowers the prices of online products. This means that the housewife can now buy goods at a low price sitting at home. Due to increasing the circulation of digital payments, they save time and travel. It increases the comfort and ease in the life of the housewife. 5. Inflation and influence on the standard of living inflation, that is, the increase in prices of everyday goods and services affects the life of the housewife. If the GST rates are low, the decline in the price of goods helps control inflation. This directly improves the standard of living of the housewife. The housewife does not struggle to maintain the same standard of living as a result of low prices. The purchase of essential commodities for the family can be easily done. 6. Spiritual and social effects also affect low prices and increased savings. The housewife feels less financial pressure, and she can make a better plan for the family. It also has the effect from social point of view. The ability to spend less helps the housewife to make her role more effective in the home and society. Practical Benefit by Example is that the monthly expenses of a housewife include: Goods/Service Monthly Expenses (RS) GST rate reduction (RS) Saving (RS)) New price (rupees) Dough and Dal 2000 50 1950 1950 Oil and Spices 1000 25975 Milk and Dairy Products 1500 37.5 1462.5 Domestic Cleaning Products 800 780 Electrical Equipment (Fare/Fare/Fare/Domestic Cleaning Services) 2000 100 100 100 1900

What will affect the decline in the rate of GST in the life of a duodenum?