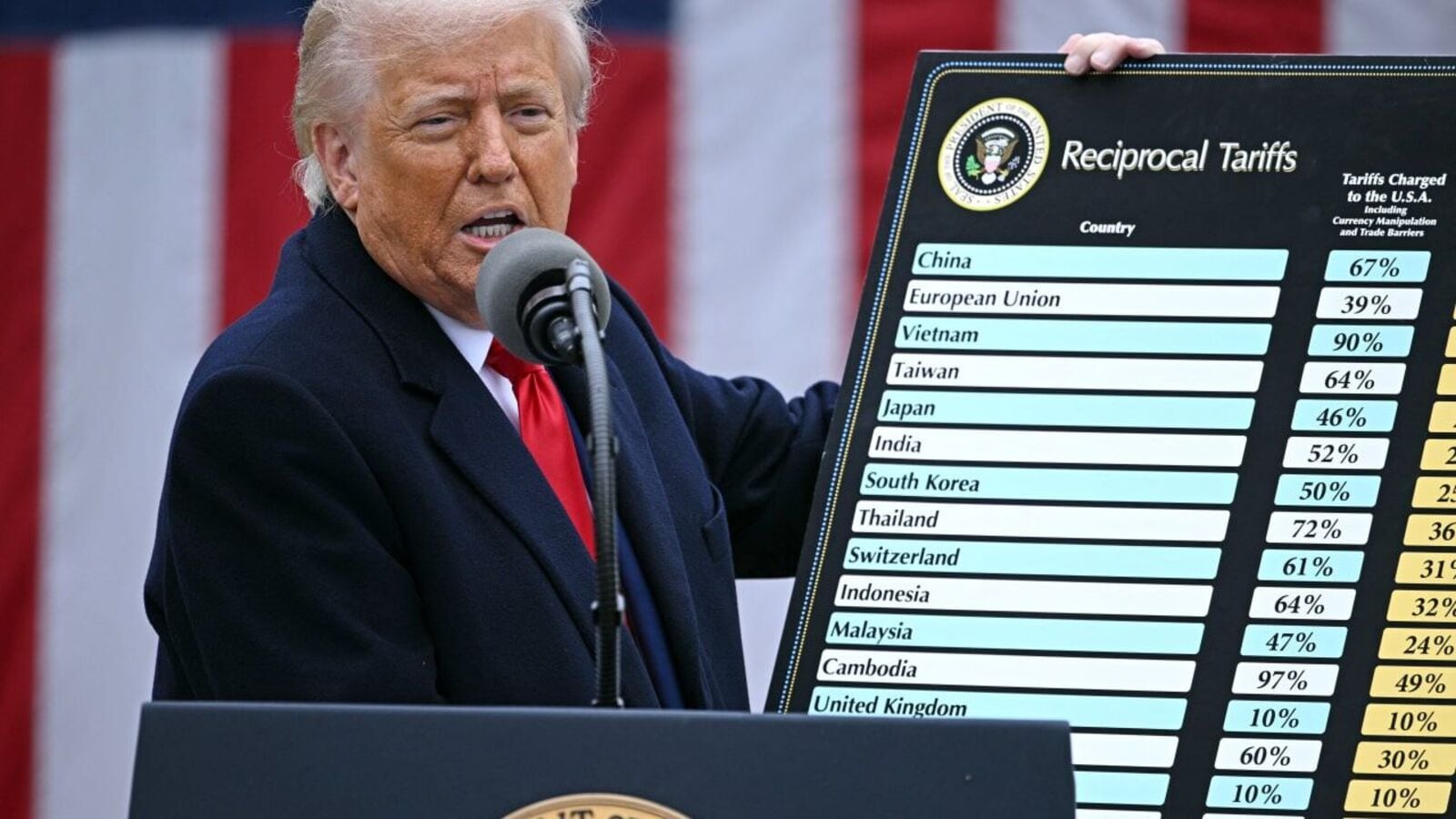

Copyright © HT Digital Streams Limit all rights reserved. The Trade Policy of America is wrong, but it seems unlikely that we will drag our back to the 1930s Manoj Pant 4 min Read 12 Oct 2025, 04:00 ist to begin with, 2025 differs much from the 1930s. Summary of Trump’s tariff increases has brought world trade and economic progress in uncertainty. However, before increasing the ghost of a catastrophe in the 1930s, we must investigate the shock absorbers that exist today, who did not do at the time. Can this pillow walk around the world this time? An analysis. US President Donald Trump’s Tariff Gambit has undeniably thrown into turmoil. By relying on a series of bilateral tariffs, he effectively set up the multilateral framework of the World Trade Organization (WTO). Technically, “the most favorable nation tariffs under the WTO rules remain in place, and his proclamations still require judicial clearance, as questions continue to bypass the US Congress to act. But if his justification of “national security” fails, he will probably fall back on another pretext, and perhaps call for section 301 of the US Trade Act that enables retaliation against “unfair trading practices”. With the largely compliant lawmakers supporting him, the likelihood of any tariff role seems. More worrying is his decision to link trade transactions with non-trade issues, political loyalties and even personal considerations. Such movements are only possible in an after -cold war world, but they have provoked two important anxiety. The first is that she can attract a “weather” again “maneuvers in West Asia and Ukraine a larger world conflict. The second is the risk of slipping in a global recession in the 1930s style. The geopolitical dimension requires a broader discussion. Here, however, the focus is on the economic question: Is a tariff war inevitable and can it shrink worldwide trade? Although Trump’s unilateral political style is deeply disturbing, the evidence indicates that his trade pambit is unlikely to cause a tariff-induced global depression. For starters, 2025 is very different from the 1930s. At the time, the world worked on the Gold Standard, as opposed to today’s flexible exchange rate system. In the 1930s, unilateral tariff increases by the US increased domestic prices, reducing import demand. Executive countries responded with retaliation tariffs to protect their housing markets, creating a spiral of ‘competitive tariff residence’. The result was catastrophic: World trade has shrunk by almost 60%. By contrast, pillows of today’s flexible exchange rates such shocks. Currency depreciation can take up much of the impact, and ensure that prices in export markets remain relatively stable. Although some immediate price adjustments occur, the gradual depreciation of the depreciation is over time-a process known as “exchange rate passes”. Evidence of this is already visible. According to the Dxy index maintained by the US Federal Reserve, the dollar has weakened by about 4.2% against major currencies over the past six months. Commodity trade, often the most sensitive for rates, has been stagnant in real terms since 2008, even as trade has grown in services. In many cases, businesses absorb tariff -related costs rather than transfer it to consumers, especially if the demand is price sensitive. After all, market access is the short -term profitability. The US trade representative research confirms this: a 1% tariff increase has led to only a 0.25% increase in domestic prices over the past year. Trading firms compensate costs through exchange rate adjustments and slimmer profit margins. As runaway price increases caused the destructive tariff wars in the 1930s, the current environment makes a repeat much less likely, especially given the attracting the large US market. Another important distinction between today and the thirties lies in the structure of the world trade itself. Direct Direct Investment (FDI) now plays a central role, with about 60% of trade between subsidiaries of multinational enterprises. Much of this trade involves intermediate input compiled in final products within Global Value Chains (GVCs). As GVC trading is powered by transnational corporations, borders can be moved to reduce the impact of rates. In fact, global corporations can treat tariff-induced costs as ‘trading costs’ and adjust their supply chains accordingly. And trade and FDI are just two sides of the same coin. Global production networks already adapt to rates. For example, large Indian textile exporters move operations to Vietnam, Myanmar and Bangladesh to maintain access to the US market. Such restructuring allowed to continue, as what is taxed in one jurisdiction can be reclassified as deductible costs in another. The result is that overall profits remain protected, even as the supply chains shift. This adaptability is precisely why Trump’s vision of reviving US manufacturing by rates is unlikely to be realized. In short, although Trump’s political one -sidedness can destabilize mitics, his tariff strategy is unlikely to push the world into a repetition of the thirties. Flexible exchange rates, multinational corporate networks and global value chains serve as shock absorbers. Rates do create uncertainty and inefficiency, but this will not lead to the kind of trade collapse almost a century ago. Also note that due to the large depression of the thirties, there is a multilateral system of institutional cooperation, even if Trump pulls the US out of it. The Multilateralism of the WTO suffered a setback, but mechanisms for cooperation existed in other fora. All that is taken into account will frustrate today’s networks of commercial arrangements, regional trading, or Trump’s goal to bring manufacturing back to the US to the US. The impact that Trump will have on world trade is limited. But its impact on international political relations can leave an indelible mark and geopolitical implications. But then 2028 is not that far away. The author visits Professor, Shiv Nadar University. Catch all the business news, market news, news reports and latest news updates on Live Mint. Download the Mint News app to get daily market updates. More Topics #india China #Pli #Manufacturing Read Next Story

Why Trump’s Rate Gambit does not call ghosts of the Great Depression