,

سقوط وتحطم صاروخ فضاء “إيريس” بعد 14 ثانية من تحليقه شمال ولاية كوينزلاند في #أستراليا

النشرة الإخبارية اليومية

اشترك في النشرة الإخبارية حتى تصلك آخر الأخبار

شكراً لتسجيلك معنا

سوف تصلك أهم الأخبار عبر بريدك الإلكتروني

النشرة الإخبارية اليومية

اشترك في النشرة الإخبارية حتى تصلك آخر الأخبار

شكراً لتسجيلك معنا

سوف تصلك أهم الأخبار عبر بريدك الإلكتروني

المزيد من اقتصاد الشرق مع Bloomberg

الأكثر تداولا في إقتصاد

كيف تفعل الوضع المظلم (Dark Mode) في جهاز الكمبيوتر الخاص بك؟

,

كيف تفعل الوضع المظلم (Dark Mode) في جهاز الكمبيوتر الخاص بك؟

سواء كنت تعمل لساعات طويلة أمام الشاشة أو تفضل المظهر الأنيق والمريح للعين، فإن الوضع المظلم (Dark Mode) أصبح خيارًا أساسيًا في أنظمة التشغيل الحديثة. لا يقتصر هذا الوضع على الجانب الجمالي فحسب، بل يُسهم في تقليل إجهاد العين، خاصة في البيئات منخفضة الإضاءة، كما قد يساعد في توفير طاقة البطارية على الأجهزة المحمولة.

في هذا الدليل العملي، نستعرض كيفية تفعيل الوضع المظلم في نظام ويندوز 10 أو 11 خطوة بخطوة، مع شرح مبسط لكل خيار يتيح لك تخصيص المظهر كما يناسبك.

عن طريق إعدادات النظام تعتمد تلك الطريقة على تغيير إعدادات الإضاءة عن طريق إعدادات النظام.

افتح الإعدادات (Settings) اضغط على زر ابدأ (Start) ثم اختر الإعدادات (Settings) من القائمة الجانبية. أو استخدم الاختصار Windows + I للوصول السريع.

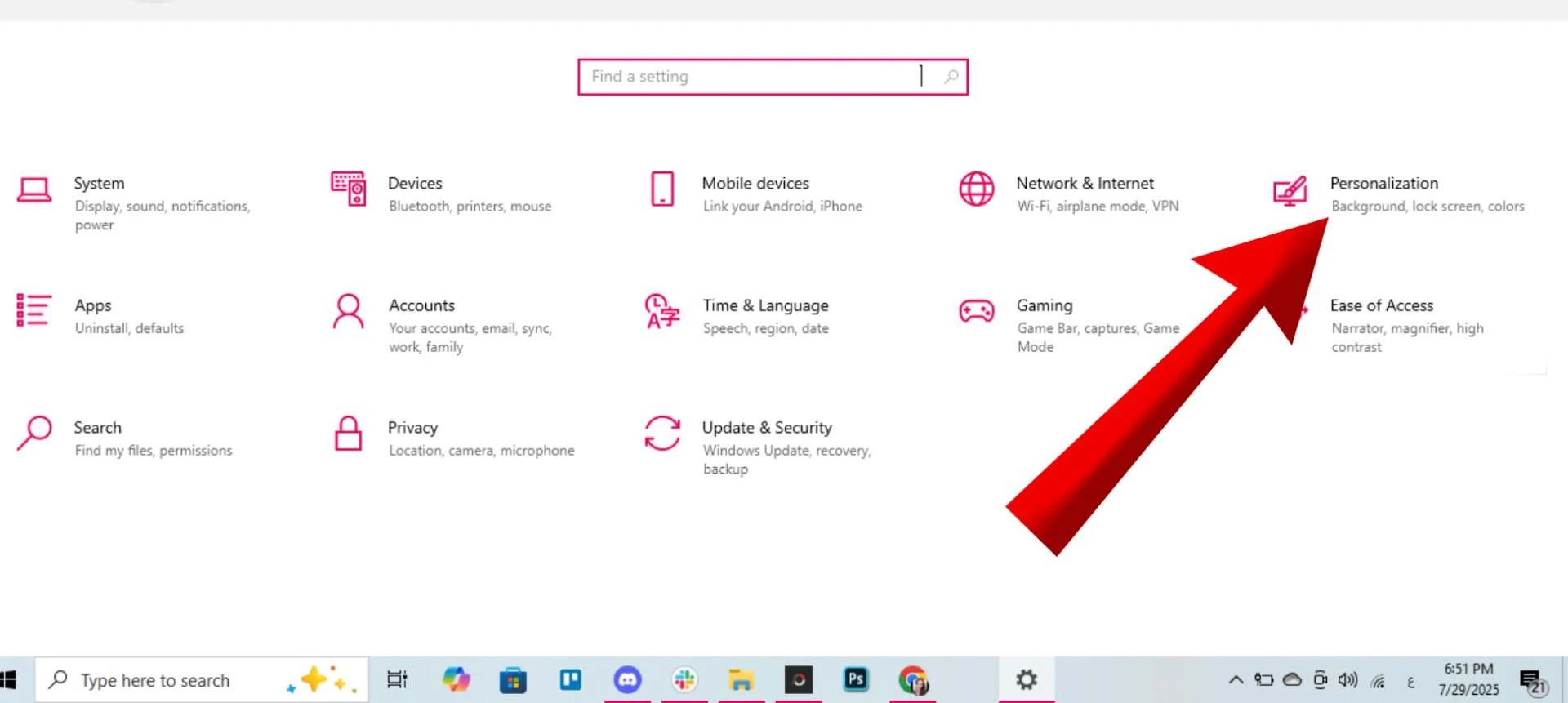

ادخل إلى قسم التخصيص (Personalization) في نافذة الإعدادات، اختر قسم التخصيص، وهو المسؤول عن إعدادات المظهر والخلفيات والألوان في جهاز الكمبيوتر.

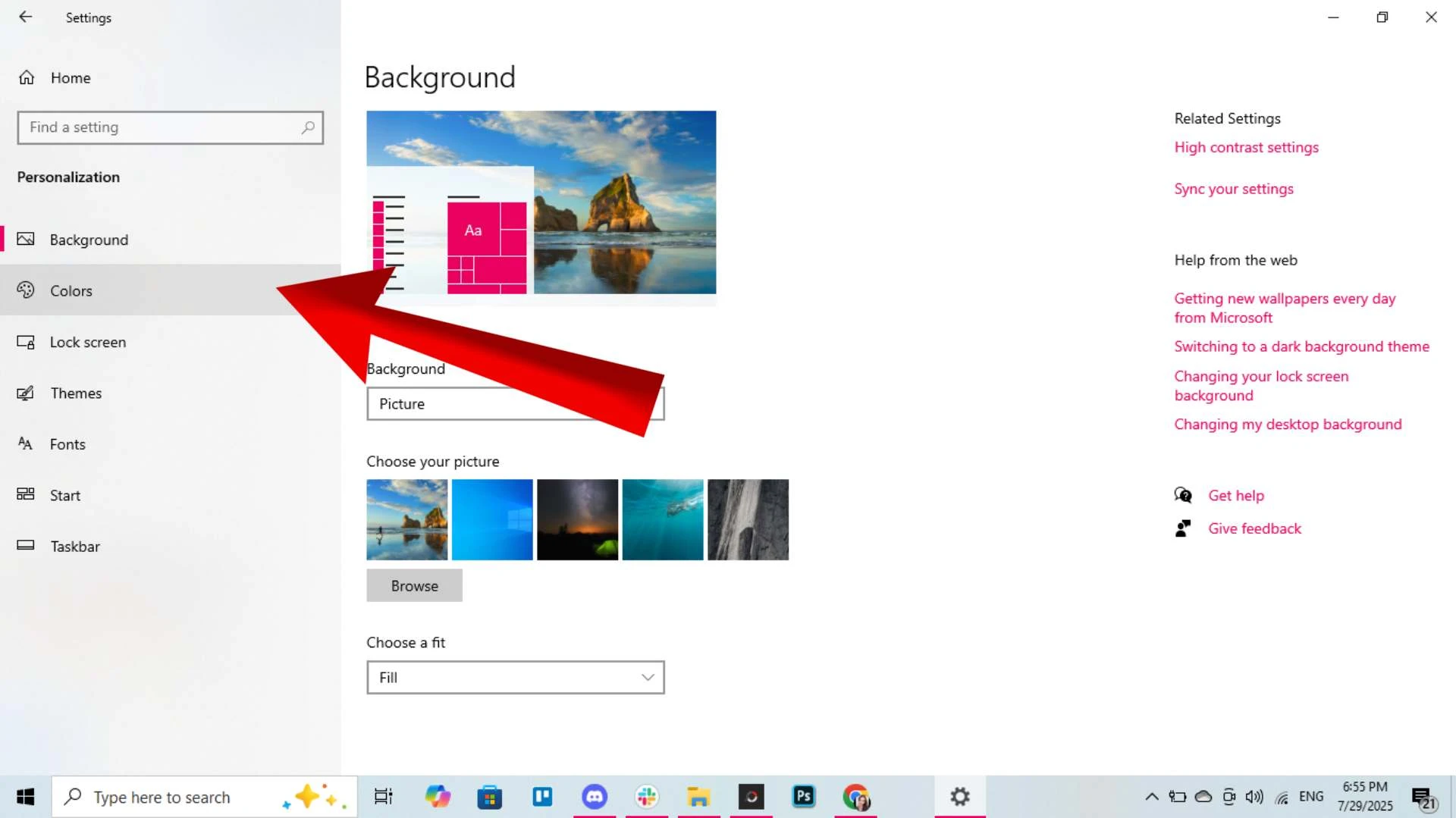

اختر الألوان (Colors) من القائمة الجانبية داخل قسم التخصيص، اضغط على خيار الألوان للوصول إلى إعدادات السمات وأنظمة الألوان.

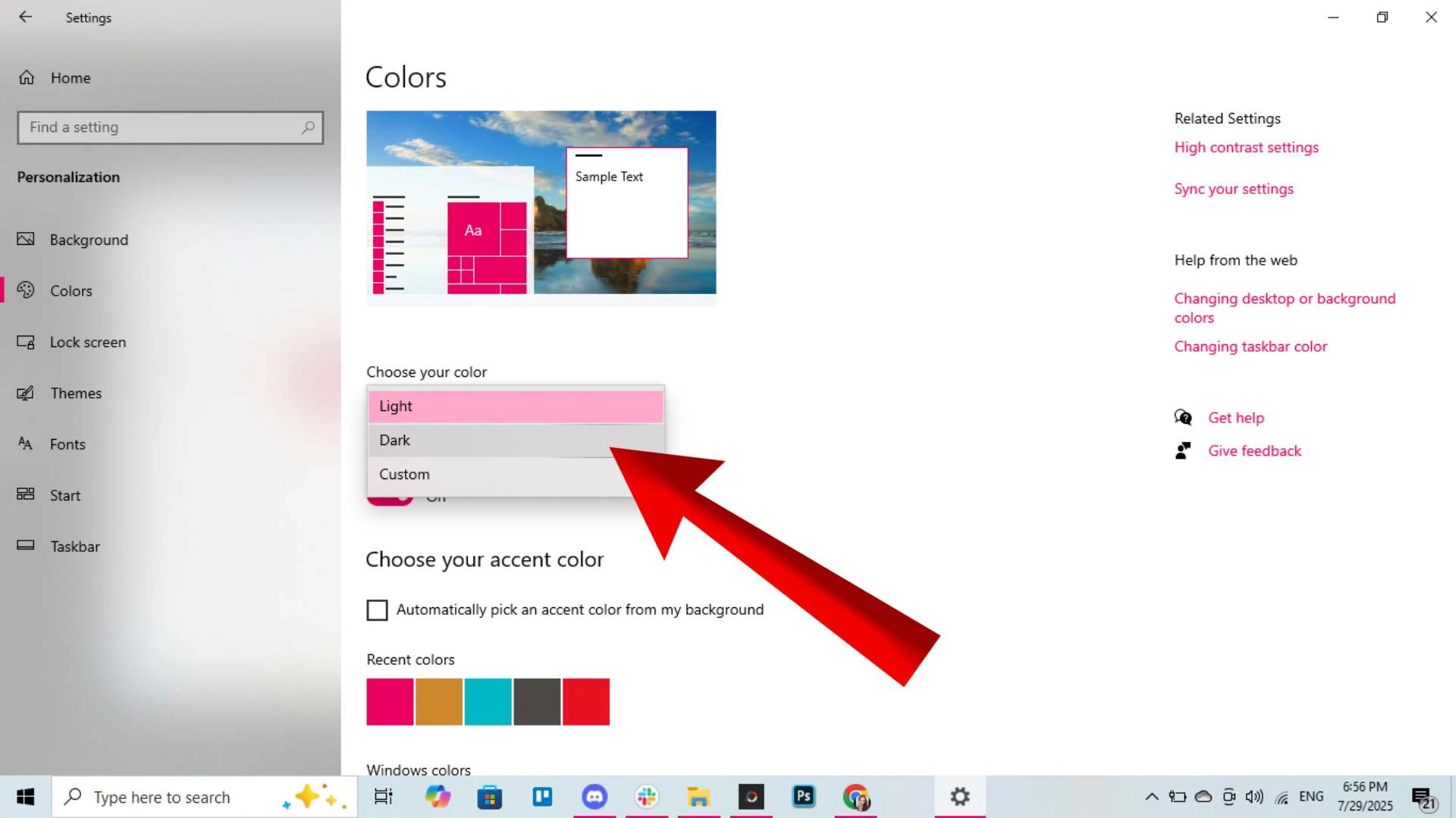

حدد وضع التطبيق من القائمة المنسدلة تحت عنوان اختر الوضع (Choose your mode)، ستجد قائمة…..

لقراءة المقال بالكامل، يرجى الضغط على زر “إقرأ على الموقع الرسمي” أدناه

النشرة الإخبارية اليومية

اشترك في النشرة الإخبارية حتى تصلك آخر الأخبار

شكراً لتسجيلك معنا

سوف تصلك أهم الأخبار عبر بريدك الإلكتروني

النشرة الإخبارية اليومية

اشترك في النشرة الإخبارية حتى تصلك آخر الأخبار

شكراً لتسجيلك معنا

سوف تصلك أهم الأخبار عبر بريدك الإلكتروني

المزيد من عرب هاردوير

الأكثر تداولا في تكنولوجيا

BMW تطلق أول سيارة بالهيدروجين في 2028

,

BMW تطلق أول سيارة بالهيدروجين في 2028

رغم أن سيارات خلايا وقود الهيدروجين طُرحت في الأسواق بالتوازي تقريبا مع موجة السيارات الكهربائية التي تعمل بالبطاريات، إلا أن الإقبال عليها لا يزال محدودا.

في 2024، تم تسجيل 12866 سيارة تعمل بخلايا وقود الهيدروجين عالميا، مقابل 10.8 مليون سيارة تعمل بالبطاريات.

رغم ذلك، لا يزال بعض المصنعين يأملون في أن يلعب الهيدروجين دورا في قطاع النقل.

ومن بين هذه الشركات بي إم دبليو، التي أعلنت أنها ستطلق أول سيارة تعمل بخلايا وقود الهيدروجين في 2028.

أجرت مجلة فورتشن مقابلة مع يورجن جولدنر، المدير العام لمشاريع تكنولوجيا الهيدروجين ومشاريع المركبات في مجموعة بي إم دبليو، في قمة عُقدت أخيرا للترويج للسيارات الكهربائية التي تعمل بخلايا وقود الهيدروجين، إلى جانب عدد من أنصار الهيدروجين.

كانت تويوتا الشركة الرائدة في بيع سيارات الهيدروجين مع إطلاق سيارة ميراي في 2014، لكنها ليست الشركة الوحيدة في هذا المجال.

بدأت هيونداي ببيع طراز نيكسو منذ 2018، وهوندا، بعد طرحها سيارات متنوعة تحت اسم كلاريتي بين 2008 و2021، طرحت سيارتها CR-V e:FCEV الهجينة التي تعمل بالهيدروجين في 2024.

أما بي إم دبليو، فقد كانت أكثر حذرا، إذ بدأت باختبار سيارات الهيدروجين مع مجموعة تجريبية من المركبات القائمة على طراز X5 منذ 2023. وتُعد سيارة iX5 الهيدروجينية سيارة عملية، بفضل قيادتها السلسة وتصميمها الداخلي المألوف.

مع ذلك، لن تكون بالضرورة السيارة التي ستطلقها بي إم دبليو في 2028.

يقول جولدنر إن الميزة في سيارات الهيدروجين أنها في الأساس سيارات كهربائية، لكن الفرق يكمن في طريقة تخزين الطاقة، إذ تستخدم خلايا الوقود بدلا من البطاريات. وهذا يتيح إعادة استخدام عديد من المكونات مثل المحركات الكهربائية المستخدمة في سياراتنا الكهربائية .

كما أن هذه التقنية تتميز بميزة فريدة، فهي تجمع بين مزايا القيادة الكهربائية مثل التسارع، والهدوء، وانعدام الانبعاثات مع إمكانية التزود بالوقود خلال 3 إلى 4 دقائق فقط، لتكون السيارة جاهزة للانطلاق من جديد.

مشكلة البنية التحتية…..

لقراءة المقال بالكامل، يرجى الضغط على زر “إقرأ على الموقع الرسمي” أدناه

النشرة الإخبارية اليومية

اشترك في النشرة الإخبارية حتى تصلك آخر الأخبار

شكراً لتسجيلك معنا

سوف تصلك أهم الأخبار عبر بريدك الإلكتروني

النشرة الإخبارية اليومية

اشترك في النشرة الإخبارية حتى تصلك آخر الأخبار

شكراً لتسجيلك معنا

سوف تصلك أهم الأخبار عبر بريدك الإلكتروني

المزيد من هاشتاق عربي

الأكثر تداولا في تكنولوجيا

The dollar concludes the best months of Trump, supported by the power of the economy

The dollar concludes the best months in 2025, with the continued progress of the world’s largest economy and the signature of President Donald Trump trade agreements. The immediate index of the dollar “Bloomberg” rose 2.5% during July, the first month to have a positive performance since President Donald Trump swore in January last year. While federal reserve officials said growth was delaying, the data this week showed that the US economy grew by 3% during the second quarter, a strong number given the changes in commercial policy. The interest is great, the dollar supports, as Federal Reserve chairman Jerome Powell on Wednesday indicates that interest rates could remain high for a longer period, which contributed to the dollar index rising to reduce the total losses for this year to 7%. The dollar settled on Thursday after a five -day series of profits. Also read: Trump: The best strong dollar .. but the useful decline said Nathan Toufat, the manager of the first portfolio in ‘Manulife Investment Management’: its highlight. “The interest rates now show a possibility of only 40% for the Federal to take a reduction in September, and an 80% probability of movement in October, after seeing steps as confirmed before Powell spoke on Wednesday. See also: The dollar has the highest level in 5 weeks before the expected US data that the dollar recovery is a transformation. Its policy, together with the tax reduction, which was undertaken to expand the US budget deficit, undermined the dollar’s position as an ideal reserve currency. Work report on Friday gives a new lecture on the performance of the US economy. Powell also pointed out that there are different economic reports, including the provision of US stocks in the US livestock, and the eye of the eye on the livestock can change. Market also contributes to the support of the dollar. not happening. Euro or the yen, is Trump’s withdrawal of trade agreements that are in the interests of the United States more than its commercial partners. The euro fell by 3% against the dollar this month, while leaders in the industry in Germany warned that customs duties would make Europe less competitive. You may also be interested in: Trump: The best strong dollar … But its decline is useful, says Brent Donnelli, president of Spectra Markets and Veteran Currency Trader. “The agreement increases the old model of the dominance of the United States. Regardless of how the details analyze, the trade agreement appears to be an embarrassment to Europe.” The yen and the sterling pound were the worst in the tenth group against the dollar in July, as each of the two currencies lost at least 3.5%. As for the Canadian dollar, it was the least descending. In the coming months, the options contract data shows that traders expect modest profits in a transformation compared to Mayo and June, when they bet on further decline.

The US “NBA” Basketball League Study the first extension in 20 years

The American National Basketball Association (NBA) officially started the expansion procedures for the first time in more than two decades. Al -douri commissioner, Adam Silver, said at a press conference on Tuesday that the Association of the Association, which includes a representative of each of the thirty clubs, has assigned executive management to carry out an “in -depth analysis of all issues associated with expansion, whether economic or not economically. The city of Charlotte joined North Carolina and is currently being “Hornz” to the League competitions. -Saar rights in the next year. that these fees could be $ 5 billion before Boston Celtics was sold for $ 6.1 billion in March, and in June the sale of Los Angeles Lakers, according to a $ 10 billion assessment. Seattle offered the ‘Superonix’ team until 2008, when he was transferred to Oklahoma and renamed Thunder. Knights “team in the Hockey League, also leads similar attempts, along with Mark Lasri van Avenue Capital. In Seattle, Samantha Holway is the most prominent names leading the efforts to return the tire to the city. expressed her explicit interest in annexing an extensive basketball team.

Trump fees are accepted by the markets after a sharp rejection at the beginning

Financial markets received the customs duties agreement concluded by US President Donald Trump with Indonesia without a stir on Wednesday, indicating that the rate of about 20%, previously considered punishment, now applies. The performance of the shares and other assets in Asia was contrary to Trump, 19% on customs fees on Indonesian goods. The shares in the country in Southeast Asia increased from the optimism that the new fees were at least less than 32% that the president was initially threatened. Vietnam’s shares have also climbed since Trump said in early July that he had reached a trade agreement with the country. Fees negotiation tools The current calm is a shift compared to what happened earlier this year when the collapse was on the market, including secure ports such as Treasury bonds, very sharp in April after Trump imposed international customs duties on “Tahrir Day”, which led to him suspended within days. Now the markets are looking at these drawings as just negotiating pressure tools that the president uses to withdraw commercial concessions. Several indicators of financial markets fluctuations, such as the ‘Ice Mof’ index, issued by the ‘Ice Bofa Move’, for US Treasury bonds, recorded the lowest levels in years. While countries such as India and Vietnam have tried to reduce the reduction of US customs duties to a much less than 20%, Trump said he is considering drafting comprehensive fees of between 15% and 20% on most commercial partners. This indicates that 20% is no longer considered punishment, but rather has become a standard in negotiations. Transiary with Asia with some certainty, Humin Lee, the macro economic strategy of Lombard Older in Singapore: “The apparent agreement between Indonesia and Tyrm, together with the agreement between the United Kingdom and the United States, and the agreement between Vietnam and the United States, shows that American dewteeries will remain in a series of 10% to 20%.” He added that there is some relief in Asia, but investors are still adopting the guard and anticipation approach, as the fees imposed on the European Union, Mexico and Canada – combined with half of US imports – are still being prepared. The agreement between the United States and Indonesia will be concluded with a country targeted by customs duties that Trump sent last week. These messages were considered an attempt to increase the pressure on negotiators before the date of August, the date scheduled to begin the entry into force of the high fees. Rajev de Milo, the director of the governor at Gama Asset Management SA, said that trade agreements could perform Asia markets: Trump suggests that the fees impose on medicine and exclude many new transactions, but that “the levels of US fees at 20% are a worrying development because it can lead to real fees.” Some analysts believe that the latest agreement is useful for a broader Asian origin group. Standard Chartered Wealth Manegement Group in Singapore, in an interview with Bloomberg TV, said the US agreement with Indonesia “will help reduce the uncertainty in the field of trade.” And she continued: “The conclusion of more trade agreements between the United States and its partners in Asia should help reduce the state of marginal uncertainty, and Asia markets, with the exception of Japan, excel at achievements.” Market sensitivity to fees news has dropped, others indicate the sensitivity of the market in general for customs duties. Strategists at Bank of America, including Rich Samadia in Hong Kong, wrote in a note published on Tuesday: “Investors’ concern quickly draws back to President Trump’s escalation positions in the trade war, even though he has expanded the extent of conflict.” They wrote: “The latest bank managers’ polls of the bank reflect this increasing optimism, as 70% of participants see a slight negative impact on the economy and markets of Asia, in a reading that is the most optimistic since December.” US Treasury bonds remained in 4.48%for ten years, near their highest level in five weeks.

Investors reveal to Al -Sharq their plans to explore gold in Egypt

Egypt is increasing its efforts to increase the investments addressed to the mining and gold sector, as it aims to attract one billion dollars annually by 2030, in addition to increasing gold production annually to 800 thousand ounces during the next six years. The country has already attracted local and international companies that have begun exploration and production operations in areas where the concession has the law. AL -SHARQ channel interviewed presidents and managers of various companies active in Egypt in this area, on the sidelines of the mining forum held in Cairo, where they revealed their continued projects and future plans related to the exploration and production of gold in Egypt. The start was at Gillian Duran, executive director and financial officer of “Anglo Gold Gold ICTA”, an investor in the Gold’s diabetes mine, stating that her company completed her acquisition of the mine in November last year. She noted that the production of gold from the diabetes mine is annually 450 thousand ounces, which is equivalent to 15% of the company’s production worldwide, “which supports the center of our business as the fourth largest gold production company in the world.” The benefits of the Egyptian diabetes mine Duran pointed out that the diabetes mine is one of the most important assets of the business, “because it is characterized by a long life and a decrease in production costs and an ability to expand,” and adds that it has a large number of workers, 97% of the Egyptians. It is estimated that Egypt produces approximately 15.8 tonnes of gold annually, most of which come into the eastern desert, in addition to the “Hamash” and “staff” mines. Hani Mustafa, chairman of the Egyptian “Shalatin Mineral Resources” council, revealed that the company is preparing gold mining auctions next month for the launch, which will be available for international and local enterprises within its privileged area between the two linear and 24 degrees of Sub -Saharan. He added during an interview with “Al -Sharq” that the company has allocated 100 million pounds for a three -year -old self -exploration project for “Hanajlia” and “Umm old” in Marsa Alam, and noticed that the initial indicators indicate a discovery of commercial sizes, “but it is too early to accurately determine the volume reserves at this stage.” As for the industrial complex, which the company owns in Dahit in Aswan, Mustafa said that the construction work of the project, which stretches more than 1420 hectares, is completed by up to 70%, and the completion of the complex is expected at the beginning of next year, and it is estimated that the production of the business would be raised at the time. ‘Shalatin’ owns ‘the Egyptian General Authority for Mineral Resources’ 35% of the ‘Shalatin’ company, while the ‘National Service Projects’ of the Ministry of Defense owns 34%. As for the national investment bank, it owns 24% of the company, and the Egyptian resource business owns 7%. As for Amr Al -Mirrafawi, head of the Egyptian “Horizons” group, he said that the company was preparing to announce the discovery of gold next October, and explained that this discovery came as a result of exploration and exploration work in only a small area in ‘romat’ within the concession area of 500 square kilometers. Al -Mirrafawi has continued that the company has so far pumped more than $ 20 million on research and exploration, while it aimed to pump new investments of $ 10 million and $ 15 million during the next year. Discussions with the Egyptian government hold ‘prospects’ with the Egyptian government to establish a gold production factory, which will be built for two years and the investment volume is about $ 50 million, according to Al -Marharawi. In the same context, the Canadian company “Aton Resources” allocated $ 60 million to the establishment of a gold extraction and processing factory in the “Hamama” area, which is expected to start with an annual production volume of 25 thousand ounces within two years, according to CEO Tono Fahk. He said during an interview with ‘Al -Sharq’ about the project: ‘Despite his childhood, it is a good start that enables the presence of mining companies working in Egypt, and it starts to create positive cash flow for the business.’ He revealed during an interview with ‘Al -Sharq’ that the company in Egypt has invested more than $ 50 million in search and exploration, and plans to spend up to $ 90 million before starting commercial production. In January 2024, the company “Aton Resources” obtained a privileged mining license with an area of 57.66 square kilometers, which covers the two areas of West and Roderin, for a preliminary 20 -year period, along with an extra exploration space of 255 square kilometers, which was still four years. In June of the same year, a joint company was established between the Egyptian General Authority for Mineral Resources and the company “Aton” in preparation for the start of the commercial detection exploitation.

Trump is likely to impose medicine and exclude numerous new offers

President Donald Trump said it is likely to impose customs on medicine by the end of the month, and that the definitions of semiconductors may also come soon, indicating that these fees can be applied to imports along with a large scale ‘mutual’ definitions that can be implemented on August 1. ‘To adopt (manufacturing facilities), and then we will make them very high fees, “Trump told reporters on Tuesday as he returned to Washington after attending a summit on artificial intelligence in Pittsburgh. Trump added that the timetable for the implementation of the fees on semiconductors was” similar “, and Additional details to be provided. Medicine has already announced medicines under Article 232 of the 1962 Trade Expansion Act on Medicines, saying that the flow of foreign imports will threaten national security. Costs. Prefer Mono -Side fees earlier Tuesday, Trump announced an agreement with Indonesia, which reduced the 32% fees announced in one of the messages to 19%. Transactions with countries were able to call a mutual customs duties, saying that the states that have the United States do the United States. I think this whole effect will disappear, ‘Trump said.

Expected momentum in the vague until the end of 2025

The UAE awaits a renewed momentum in the stock markets with the entry of the second half of 2025, while investors balance the judgments of Saudi businesses that want to include the stock exchange. The planned transactions in the UAE are based on the successful offer of the investment fund in the “Dubai Ret Housing” in Residential Estate last May, which contributed to the revival of the moral after a series of quiet inductions late last year. According to well -known people, “Alex Engineering & Contracking LLC” meetings with investors in preparation for a possible listing after summer. According to Bloomberg, also prepared for several proposals related to the real estate sector, which includes the ‘Arabian Construction Co’ and the classified Ads platform ‘Dubizzle’ (.dubizzle Ltd). Dubai Holding, owned by Dubai Ruler, plans to launch a portfolio of malls and other commercial assets, and utilize the strong performance of the Dubai Ride Houses. The superiority of Emirati proposals, although most of the wave markets generally avoid the fluctuations due to regional conflicts and uncertainty about customs duties, the UAE excelled in its performance. “The UAE is more durable, less associated with oil, and the diversification of the economy has yielded over the past year,” said Ramy Sidani, the investment head of the promising markets of “SchroDe Investment Management”. In Abu Dhabi, Mubadala Investment Company is selling part of its one billion dollars share in the telecommunications company “Du”, by a secondary offer expected to be launched after the summer, according to people who are familiar. Representatives of “Alec” and “Mubadala” refused to comment on the matter. Although secondary offices in the region are still relatively limited, their size in the Emirates exceeded the initial subscriptions during the first half of 2025, powered by large transactions such as the “ADNOC gas” launch, which collected about $ 3 billion, and “Abu Dhabi First Bank”, which collected $ 477 million. According to Rudi Saadi, head of the capital markets for shares in the Middle East and Africa at City Group: “We have begun to notice a slight shift. Not only all versions in the capital markets deal only with the initial subscriptions, but there is an increasing discussion of shareholders about different products, which the market needs.” In turn, Saudi Arabia is still the most active market in the region in terms of initial proposals, as it raised more than $ 3 billion this year. But it enters the second half of the year at a conservative rate, amid the performance that came without expectations in the first trading of “Flynas” and “Specialized Medical”, in light of the fall in oil prices and greater prices in auditing. You may also be interested in covering ‘Flynas’ a few minutes after opening the subscription, and Saadi believes that’ investors are still interested in the Saudi market as a result of the large diversification program, but it is more selective. The actual dialogue is now dealing with the discipline of evaluation and the quality of assets. ‘ However, interest in the Saudi market is the way of suggestions in the kingdom, experiencing expansion; The ‘Andalus Education Company’ with EFG Hermes is working on a possible proposal, while ‘SNB Capital’ is used to discuss the inclusion of its educational unit in Riyadh, according to Opinth. Various businesses also seek to take advantage of the increasing demand for infrastructure, tourism and operational projects. The Mag and EFS plans for facility management to offer operations, while the Romance Restaurants series works with HSBC Holdings PLC and Hermes for a possible proposal. Representatives of “Andalusian Educational”, “Amanat”, “EFS”, “Hermes”, “Al -Hy Capital” and “HSBC” refused to comment, while “romance” did not comment on several requests, and it was not possible to “achieve” power. A number of real estate development companies such as “Al -Majidiya”, “Symbol” and “Marketing Home Group Co” specialized in building materials have obtained organizational approvals, and these companies plan to take advantage of the growing demand for housing in light of “Vision 2030” and the new rules that allow foreigners to approve. Several sectors are interested in the initial presentation of the large number of businesses in different sectors, preparing from car rental and vehicle cooling systems to financial technology, modern technologies, investment banks and cafe chains, for public offering. As far as the state enterprises are concerned, the Saudi public investment fund studies the inclusion of the Ports industry company, while Sabic wants to sell to part of its industrial gas unit, according to Bloomberg. These activities represent an actual test of investors’ appetite in an environment that has become more sensitive to prices. Sidani believes that “the evaluations in consumer sectors and medium businesses are still high,” noted that banks look more attractive in prices. He added that Saudi Arabia still represents an ‘attractive structural growth story’, which indicates a ‘broad financial space’ and continuous diversification efforts. He said that the correction of the judgments could attract more foreign investors, considering that “Saudi shares were trading with a comparative allowance with other emerging markets.” Golf investment opportunities receive the importance of investors in the market’s markets, an extra group to increase the representation of the wave states in emerging market indicators. “We are seeing an increasing trend of international institutions,” says Nikita Turkin, head of capital markets, noting that the bank gives advice to various companies led by founders in sectors such as technology, real estate, industrial and consumer goods, preparing to expand locally or internationally. Some smaller wave markets also prepare to offer; The Trolly Stores chain in Kuwait plans to offer a preliminary public, while the Golf International Services Company in Qatar, backed by the government, includes an insurance company and a supply service business linked to it.

The sun does not drown for 76 days in this country

Trending have you ever thought that there is a country where there is a night in half and half the night at the same time? There are 195 countries in the world, but only one of them is a country where people see this nature of nature every day. This country is so great that there are not one or two, but there are 11 time zones in it. For this reason, this unique situation is created here. We talk about Russia, the largest country in the world, where people do breakfast and dinner at the same time. In Russia, some people start in the morning, while some people are sleeping in the night. From May to July, the sun does not sink 76 consecutive days in some parts of Russia. For this reason, it is called ‘country of midnight sun’. Marman is a city in Russia where it does not have night about 60 days in summer. During this time there is no difference between day and night, people can only guess the time by looking at the clock. Russia is also called ‘Father of Vodka’ because it was the first use of Vodka. There are more women than men, so it is also called ‘Country of Women Dominated’. Click here Life & Style Click for more stories Click here

الكويت

الكويت السعودية

السعودية مصر

مصر الإمارات

الإمارات لبنان

لبنان البحرين

البحرين الأردن

الأردن فلسطين

فلسطين اليمن

اليمن المغرب

المغرب ليبيا

ليبيا تونس

تونس عمان

عمان العراق

العراق الجزائر

الجزائر