The breed for he dominance has fueled a world chip frenzy – nonetheless Morningsar warns the industry’s Next Cyclical Downturn Would possibly maybe well Be on the Horizon.

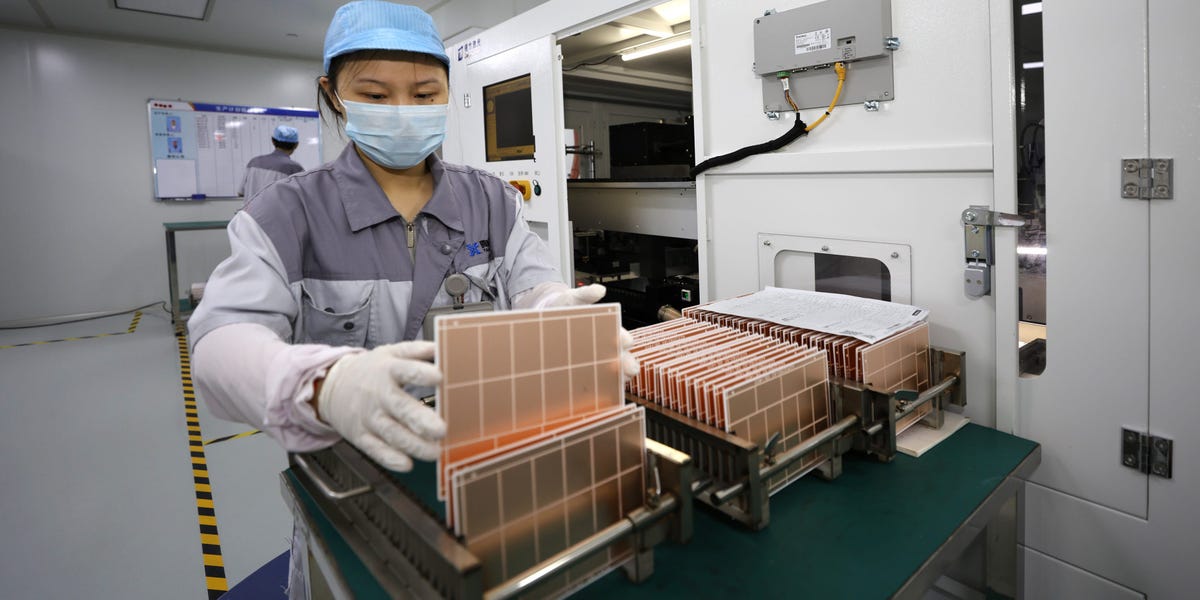

“Foundries and Memory Makers Are Uncovered to the Intense Cyclicality of the Semiconductor Sector,” Equity Analysts at Morningsar cautioned in a Document on Tuesday.

The agency said a regular semiconductor Cycle Lasts About Four Years, with he place a question to prolonging the new rally.

“We Factor in Sturdy AI-Linked Gross sales and Investments are Helping the Sector to Stretch the Limits of An Upcycle,” The Analysts Wrote.

SINCE CHATGPT’S BREAKOUT MOMENT IN LATE 2022, he Investments have surged, Sending Chipmaker Valuations hovering.

While Cloud Giants Treasure Microsoft, Amazon, and Meta Are Ramping Up He Spending, The Analysts Mentioned “The Market is simply too Upbeat on Prolonged-Time frame he Funding Growth.”

Acciting to Morningstar’s Analysis, Semiconductor Billings Growth – A Respectable Gauge of Commercial Wisely being – Has Already Started to Unhurried, Signaling the Would possibly maybe well Nearing Its Peak.

Outdoors of he, sluggish smartphone and client electronics sales are dragging on place a question to for non-ai chips.

MORNINGSTAR Now Sees he spending peaking in 2025, with threat of a Slowdown Rising in 2026 as macroeconomic threat and client place a question to stays mature.

To be sura, cutting-edge he chips dwell scarce, nonetheless Older Memory Products Would possibly maybe well Survey Softer Interrogate, They Mentioned.

While Slowing Growth Wold Hit Chipmakers, Foundries are in a Barely Stronger Situation.

Morningsar pointed to Taiwan Semiconductor Manufacturing Firm’s Technological Lead and Big US Investments as Buffers In opposition to Wretchedness. Aloof, occasions be pleased tsmc dwell uncovered to the Cyclical Swings that steadily Sweep Via the sphere, they added.

MORNINGSTAR’S WARNING LANDS AS INVESTORS WRESTLE WITH A BROADER QUESTION: How Powerful this would possibly well maybe well undoubtedly camouflage in company profits.

While a file Allotment of s & p 500 firms mentions he on earnings calls within the 2d quarter, “the proportion firms quantifying the affect of he on the earnings nowadays remeins Small,” Goldman Sachs in a New Demonstrate.

The monetary institution added that he’s financial footprint would possibly well maybe well Also be understated in executive recordsdata, Semiconductor Charges are offen bureed as intermediate inputs as a change of fleshy capted in gdp recordsdata.

Supply link