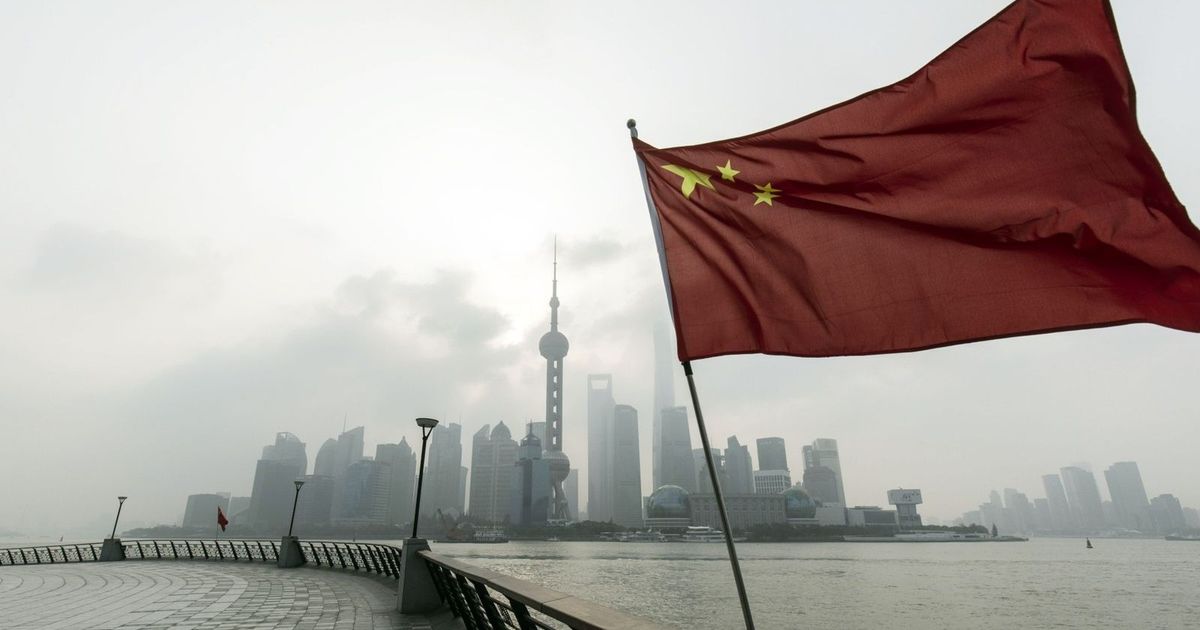

The JP Morgan Bank expects a widespread recovery in China and an increasing stake from foreign investors who want to diversify their governor, while the global customs duties system increases changes in investment portfolios and increases the rate of external expansion of Chinese enterprises, according to Rita Chan. “The developments during the past twelve months have certainly encouraged.” And “We have seen a widespread recovery in liquidity and trade size.” In recent years, the bank has reformed its leaders and reduced its operations in China and Hong Kong, in light of its awareness that the expansion lasted longer than expected, although CEO Jimmy Damon confirmed that it was still committed to the market. The presence of the Wall Street institutions in China in general has reduced the Wall Street companies in the Chinese market, where the volume of their joint exposure -including lending, trading and investing by one fifth. But there are now indications of improved cases, with the high sales of shares in Hong Kong and the most important justice of China. Chinese leaders have also renewed their commitment to the policy of financial openness and launched incentives to support the economy and return it. The markets also recovered after Beijing and Washington reached a 90 -day ceasefire over some of the highest customs duties. The major demand for border services said that the bank is seeing a ‘very strong momentum’, and that the tendency of local Chinese businesses to external expansion and globalization continues. She added that “the demand for transport services to deal with this complex environment is constantly increasing.” JP Morgan pumped significant resources to improve its business in China, the only bank under the Wall Street institutions, which managed to completely control future contract activities, securities and asset management in China within a short period of no more than three years. Wide optimism in Asia and promising opportunities in Japan, as the bank has expressed its optimism about the rest of Asia. “The bank expects growth in the region outside the world average, and indicates the presence of ‘enormous opportunities’ in Japan. In India, Lennart said that” the current leadership investors give the confidence that they will continue the same path. ” “The road is long for India, as the economy is much smaller than the economy of China,” he added. his 25 years of age lasted within the bank.

JP Morgan: The attention of foreign investors returns to China