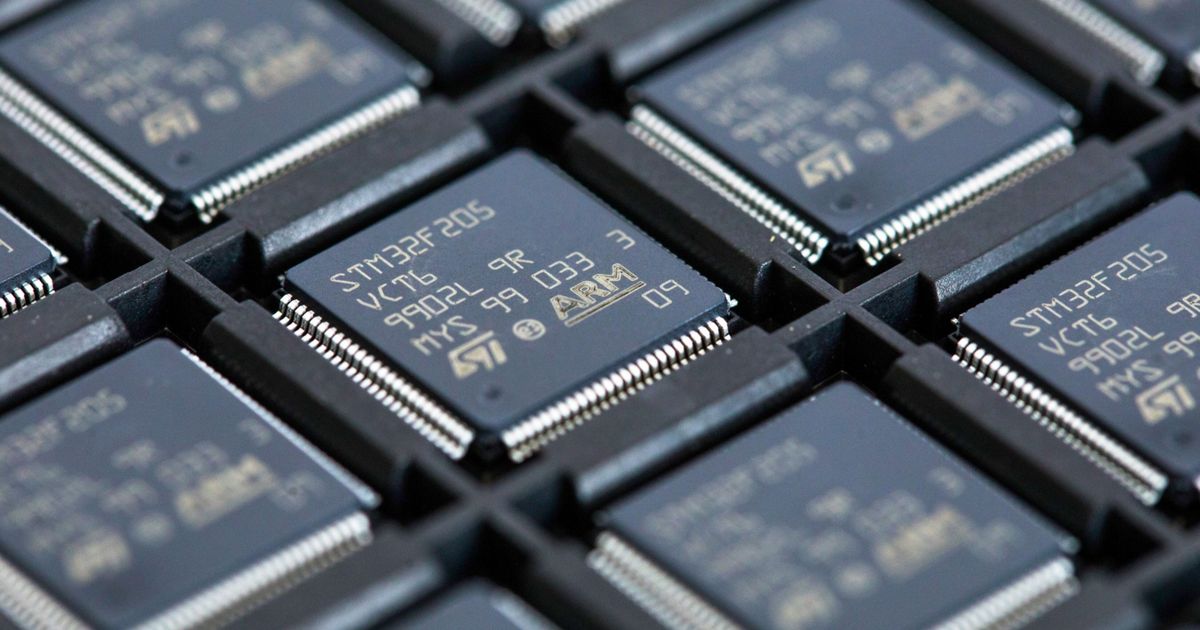

Poor Holdings decreased after the Chips designer provided lukewarm forecasts for the financial year, which had the fear of uploading artificial intelligence in the technology industry. The company said on Wednesday that revenue would range from $ 3.8 billion to $ 4.1 billion for the 2025 financial year, ending next March. The arrow profits range from $ 1.45 and $ 1.65 per share. Analysts expected a total revenue of $ 4.01 billion, representing 26%profits, and a $ 1.53 per share share. Three months ago, optimistic expectations led to the high price of the company’s share and helped to turn it into a favorite business for artificial intelligence in Wall Street. The share price increased by 41% this year until Wednesday’s closure. The designs of “poor” discs and licensed standards are an important technology for most smartphones. Under the leadership of CEO René Haas, the British company is trying to utilize this position in the presence of larger database equipment, as the requirements of artificial intelligence stimulate major promotions. As part of this group, “ARIM” offers more complete technical plans for businesses such as “Amazon Web Service”. Long -term growth said in an interview that “poor” is still “very confident in long -term growth”, and “many strategies we set up two years ago, all of which can integrate together.” The company designed for chips said sales would be between $ 875 million and $ 925 million in the quarter in June. This is compared to the average estimates of $ 868 million analysts. The profitability of the arrow, after deduction of some items, will be from 32 cents to 36 cents. Compared to Wall Street’s 31 cents expectations. In the fourth fiscal term ended in March, turnover amounted to $ 928 million. With the exception of some items, the profitability of the share has reached 36 cents. This is compared to an average estimate of $ 880.4 million and profits of 30 cents per share. The role of “arm” plays an unusual role in making semiconductors. The company licenses the basic group of instructions that use programs to communicate with discs. The company also offers the so -rounded design blocks used by companies such as “Qualcomm” to build their products. ARM moves to the provision of more complete layouts that can be transferred directly to the manufacturing phase. This transformation makes it more competitive for clients such as “Qualcomm”, but it is more valuable to others, especially the owners of major data centers. Poor, based in Cambridge, is still 90% owned by Soft Bank Group, which the company acquired for $ 32 billion in 2016. The first public offer in 2023 raised $ 4.9 billion, representing the largest list on a US stock exchange that year. Poor sales sales rose 60% to $ 414 million in the last quarter, and property rights revenue rose 37% to $ 514 million. Haas said the license revenue is an indication “for research, development and confidence in investment.”

The chips “poor Holdings” issues faded annual expectations for its income