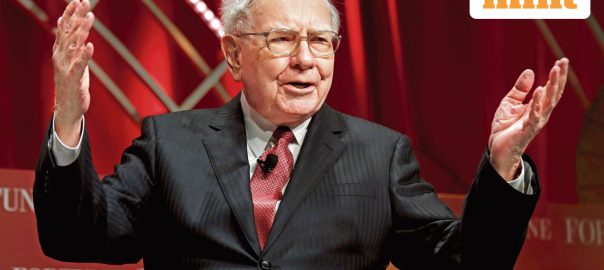

An old clip shared by X-user Investment Wisdom has reignited conversation about Warren Buffett’s enduring approach to investing — a philosophy built on patience, discipline, and an unwavering reliance on facts over predictions. More than six decades after he began managing money, Buffett’s core principles remain astonishingly relevant in a world shaped by algorithmic trading, flashy predictions and hype-driven markets. Warren Buffett, the legendary chairman of Berkshire Hathaway, has long rejected complexity in favor of clarity. His methodical, research-based style helped transform Berkshire into a multibillion-dollar conglomerate, making him one of the most successful investors in history. But as the video shows, his wisdom isn’t about shortcuts – it’s about building a foundation of knowledge that compounds, just like big investments. In the clip, Buffett emphasizes that investing is a lifelong learning discipline — one that rewards cumulative knowledge far more than speculation. “And luckily, the investment business is a business where knowledge accumulates. Everything you learn when you’re 20 or 30 can be adjusted as you go along, but it all builds up into a knowledge base that’s useful forever.” This philosophy is why Buffett never rushes into opportunities. Instead, he studies businesses deeply – through public records, regulatory filings and comparative industry analysis. He explained in the video how he once offered to buy Clayton Homes without ever visiting the company or meeting management beforehand. His conviction came not from PR pitches or glossy presentations, but from data and competitive research. Buffett’s distrust of projections is equally firm. For decades, he has publicly stated that management forecasts are unreliable and often overly optimistic. The resurfaced clip reiterates this almost contradictory stance: “We don’t give a damn about anybody’s projections. We don’t even want to hear from them in terms of what they’re going to do in the future. In most cases, the numbers tell us more than the management does.” This belief underlies Berkshire Hathaway’s consistent strategy: evaluate companies based on what they have already proven, not what they promise they will become. Why Buffett’s Advice Still Resonates With Investors In an era dominated by speculative bets, meme stocks, AI-powered predictions and overnight trading frenzy, Buffett’s message serves as a grounding reminder. His approach encourages investors to look past noise, seek durable competitive advantages and value hard data over narratives. For long-term investors, the takeaway is clear: Study companies deeply. Trust accumulated knowledge. Ignore flashing predictions. Let numbers – not narratives – guide your decisions. Buffett’s philosophy may be decades old, but as the viral clip proves, its relevance has only grown stronger. Disclaimer: The views and recommendations made above are those of individual analysts or brokerage firms, and not of Mint. We advise investors to check with certified experts before making any investment decisions.